The Invesco (IVZ) QQQ (NASDAQ:QQQ) ETF is a strong and proven choice as a fundamental building block of a technology equity portfolio. At its size, design, and liquidity it avoids any serious ETF structural worries and offers a diversified and broad sampling of the technology market through being pegged to the NASDAQ 100 index. However it suffers from being heavily weighted towards large cap technology behemoths and to even just a few among those. Furthermore, with the technology sector's immense variety of sub-sectors the QQQ ETF's particular mix may underweight, overweight, or even entirely leave out certain distinct sub-sectors that a technology investor may be interested in.

A Tech ETF That Has Risen With The Tech Sector

As shown above, since January 1st 2009 the NASDAQ composite has posted significantly higher returns than the Dow Jones, the S&P 500, and the Russell 2000. The NASDAQ composite however has been outpaced by the NASDAQ 100, which is a market-capitalization weighted index composed of about 103 of the largest non-financial NASDAQ-listed companies and the index the QQQ ETF is pegged to. Essentially, this means that growth in recent years has been primarily geared most towards large-cap technology companies as compared to nearly all other major categorizations.

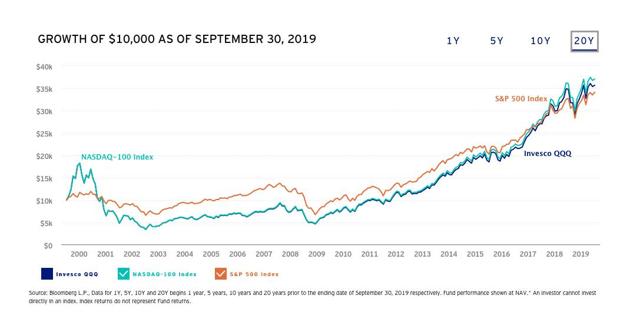

The QQQ ETF is designed to track the NASDAQ 100. Since QQQ's release in 1999 it has done so with quite close accuracy.

(Source: Invesco)

Structurally Sound But With Little Choice

From a structural standpoint the QQQ ETF is remarkably stable. It is one of the oldest ETFs and also one of the largest, whether by assets under management (currently about $87 billion) or by trading volume. It has robust liquidity and an expansive options market. It features low fees, with a total expense ratio of about 0.20%.

QQQ's negatives primarily seem to be less in