Ventas (NYSE: NYSE:VTR) is a real estate investment trust that focuses on real estate benefiting the healthcare industry. The company is one of the largest healthcare REITs in the United States, with a market cap of more than $20 billion and a dividend yield of more than 5.5%. As we will see throughout this article, the company’s impressive portfolio of healthcare properties, improvement opportunities, and dividend commitments make it a strong long-term investment.

Ventas Results and Senior Housing Challenges

Ventas has had some senior housing challenges recently, however, the company has continued to execute with the aim of generating long-term shareholder returns.

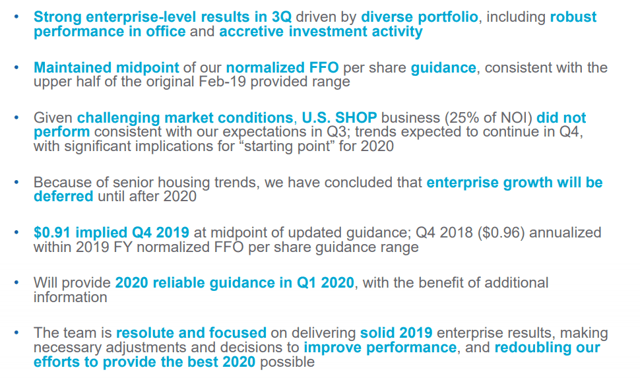

Ventas Recent Results - Ventas Investor Presentation

Ventas achieved strong enterprise-level results in 3Q due to the company's portfolio and performance. The single most important statistic worth paying attention too is the company maintained the midpoint of its normalized FFO per share guidance - that’s the cash flow that goes out to shareholders as dividends. The company has had some challenging conditions due to senior housing trends - resulting in enterprise growth being slowed down.

Going forward, the company plans to provide 2020 reliable guidance once it knows it and continues to generate cash flow. The company’s annualized dividend is $3.17 / share, which means the company’s guidance is more than enough to cover its dividend. Overall, despite its difficulties, the company has continued to perform which will reward shareholders.

More importantly, the company operates in a market that’s expected to grow rapidly, the number of ageing people in the United States is expected to increase significantly.

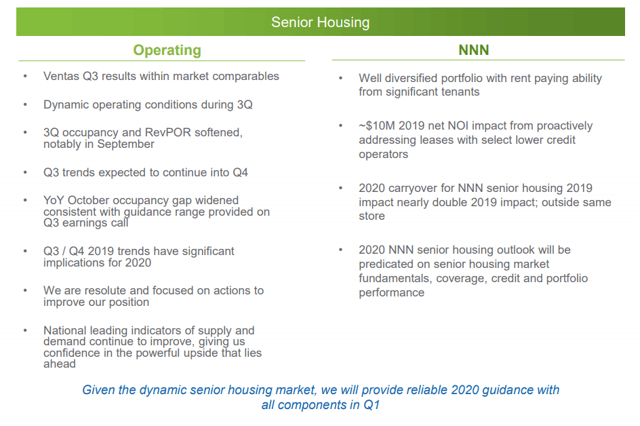

Ventas Senior Housing - Ventas Investor Presentation

The above shows the company’s Senior Housing results from an Operating and NNN point of view. In the operating point of view, the company has had to deal with dynamic operating conditions, however, recent

Invest Better - Free Trial!

Regardless of your general investing goals, The Energy Forum can help you build and generate strong income from a portfolio of quality energy companies. Worldwide demand for energy is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Deep-dive research reports about quality investment opportunities.

- A managed model portfolio that generates a yield of >10%.

- Macroeconomic overviews of the oil market as a whole.

- Technical Buy & Sell Alerts to open up positions at opportunistic prices.

If you're interested in learning more, click here. If you have any questions, send me a PM.