For 2020, maybe investors should dial down some of the risk.

That’s according to Alpha Gen Capital, which in this installment of our 2020 Outlook series says the strategy for the new year will be an emphasis on bonds and safer income vehicles. What specifically does this veteran contributor, and provider of the Yield Hunting Marketplace service, like in 2020? Muni bonds, high-yield/floating rate, real estate and REITs, and preferreds.

What do you expect to be the key driver of stock market performance over the course of 2020?

Markets climbed a wall of worry in 2019 and nearly all risk assets did very well - essentially the opposite of 2018. We believe we have entered the fear of the fear of missing out. One thing we are watching closely are equity fund flows that were down last year. It's very rare for fund flows in stocks to be negative when the market is up so strongly. But recent data suggests that may be turning. It would be a bearish signal for us to see a large amount of new money flow into equities.

During the first half of this year the story in the media was slowing growth and the yield curve "potentially," and then finally, inverting over the summer. Recession fears skyrocketed. In the last quarter - in what's a somewhat paradoxical mirror of the fourth quarter of 2018 - we saw a recovery in economic data and optimism.

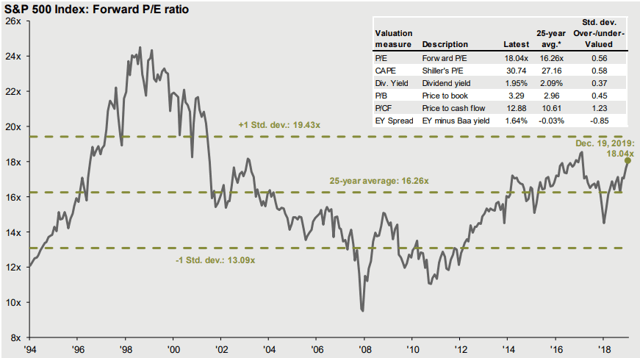

Given how far we've come in the last year with multiples expanding mightily in 2019, corporate earnings will really need to prove themselves for the market to continue higher in a sustainable fashion.

(Source: JPMorgan)

Investors know that stock prices are a discounting of future cash flows and earnings. Last year, earnings growth was very low, meaning that the rise in the market

Our Yield Hunting marketplace service is currently offering, for a limited time only, free trials and 20% off the introductory rate.

Our member community is fairly unique focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, ETFs, and mutual funds.

Check out our Five-Star member reviews.