The bull market in stocks is reaching record proportions, and prices seem to defy all kinds of concerns. In this scenario, investors have reasons to wonder if they should be buying stocks to ride the bull market higher or selling positions in anticipation of a turnaround.

Chasing prices at these levels is clearly too dangerous and should be avoided. However, as long as liquidity conditions are favorable and money is flowing smoothly through the economy, short-term pullbacks should be considered buying opportunities.

The Most Important Driver For The Bull Market

The trade war, the slowdown in manufacturing, the military conflicts in the Middle East, the coming elections and political risk, expensive valuations, and declining earnings expectations are just some of the many risk factors that have been considered as potential threats to the bull market.

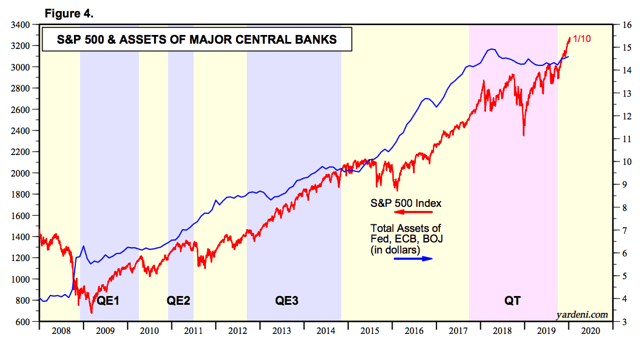

However, markets have continued to perform well in spite of all this uncertainty. This rock-solid resiliency is mostly due to the fact that the Fed and other central banks all over the world are providing massive amounts of liquidity, and such liquidity is flowing smoothly across both the real economy and financial markets.

The chart below shows the evolution of the S&P 500 (SP500) versus the size of the major central banks' balance sheets. An image is worth a thousand words, and it's easy to see how liquidity and asset prices are closely related.

Source: Yardeni Research

When companies have access to cheap credit, this provides the resources to make all kinds of investments, and also to distribute capital to investors through dividends and buybacks.

The chart below shows the relationship between the S&P 500 and high yield credit spreads, with shaded areas representing recessions. The big bear markets in stocks generally come during recessions, and recessions generally happen when credit spreads are increasing. In a nutshell, recessions and bear

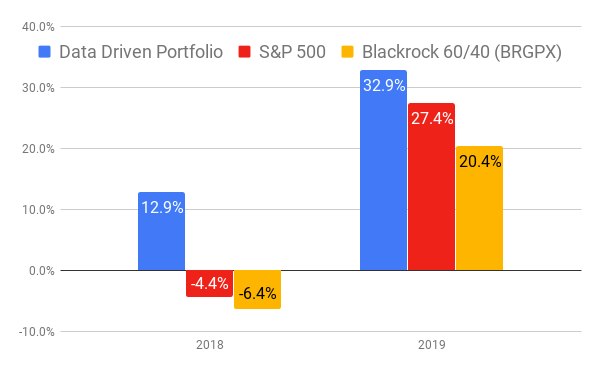

The Credit Market Model is updated monthly in The Data Driven Investor. A subscription to The Data Driven Investor provides you with solid strategies to analyze the market environment, control portfolio risk, and select the best stocks and ETFs based on quantitative factors. Our portfolios have outperformed the market by a considerable margin over time, and they are built on the basis of solid quantitative research and statistical evidence. Click here to get your free trial now, you have nothing to lose and a lot to win!

Performance as of December 31, 2019