Main Thesis

The purpose of this article is to evaluate the Nuveen AMT-Free Quality Municipal Income Fund (NYSE:NEA) as an investment option at its current market price. NEA is a fund I recommended last summer, and continue to do so today. The muni bond sector as a whole, including NEA, saw strong gains last year, and I see further upside ahead in 2020. I specifically like NEA due to its large discount to NAV, as well as high amount of leverage, which supports an income stream similar to what is offered in the high yield muni sector. Furthermore, I see muni bonds performing well this year due to the continuation of the SALT deduction limits, which is fueling demand for tax-free assets in a way similar to what we have seen play out over the last couple of years. Finally, defaults in the muni space are at historically low levels, which means investors are not taking on an excessive amount of credit risk to earn an income stream that is competitive with most alternative fixed-income sectors.

Background

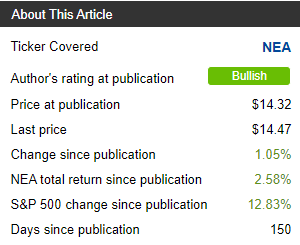

First, a little about NEA. It is a closed-end fund with an objective "to provide current income exempt from regular federal income tax and the alternative minimum tax applicable to individuals, by investing in an actively managed portfolio of tax-exempt municipal securities". Currently, the fund trades at $14.47/share and pays a monthly distribution of $.0535/share, which translates to an annual yield of 4.44%. I covered NEA for the first time back in August and recommended the fund. In hindsight, this call seems appropriate, as NEA has registered a solid gain that time, although the market as a whole has performed very well, as shown below:

Source: Seeking Alpha

Now that we have entered the new year, I am reevaluating all the funds I cover