Northern Oil and Gas (NYSE:NOG) has been working on reducing its second-lien debt, which is due in May 2023. It has been primarily using preferred stock (and a little bit of cash) in the exchanges for the second-lien debt and now has around $341 million in second-lien debt remaining. These transactions should modestly reduce its cash expenditures, and will improve Northern's ability to refinance or redeem its debt. The amount of dilution from the potential preferred stock conversion is increased though, and the outstanding preferred stock can be converted into 100 million common shares.

Debt Reduction Transactions

Northern's three recently announced debt reduction transactions involve the exchange of $76.7 million of its 8.5% second-lien notes due 2023 for 794,702 shares of its 6.5% Series A Preferred Stock and $2.6 million in cash. This reduces its outstanding second-lien principal to $341 million.

These transactions reduce Northern's annual cash outlay by around $1.25 million (the amount by which its interest costs decreased more than its preferred dividends increased). Northern's net debt decreased by $74.1 million and its preferred stock (at par) increased by $79.5 million, for a net increase of $5.4 million.

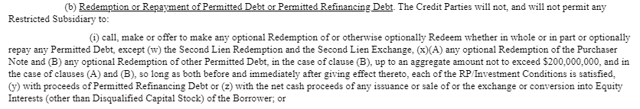

Northern's second-lien bonds mature in May 2023 and it appears that it is allowed to repurchase up to $200 million of those notes in the future using cash. Otherwise, it could refinance the debt or issue equity in order to deal with the second-lien notes.

Source: Northern Oil and Gas

It appears that Northern is making significant use of preferred stock to shrink its second-lien debt, which is a good path to take. If Northern can reduce its outstanding second-lien notes to $200 million (less whatever part of the basket it uses up in cash repurchases) by 2023, it will eliminate the refinancing risk with those notes. Reducing its second-lien debt via exchanges for preferred shares also

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historical research that now includes over 1,000 reports on over 100 companies.