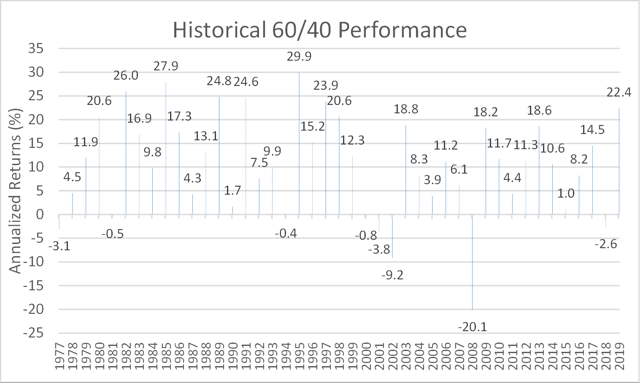

Historically, a portfolio mix of 60% stocks and 40% bonds has been a formula for long-term investing success. This heuristic was commonly used by pension funds to capture a portion of the upside of equity markets while the bond component cushioned returns in weak market environments. As equity market rallied and lower interest rates buoyed bond returns in 2019, 60/40 produced tremendous performance. However, the traditional 60/40 portfolio still underperformed a strategy that I have previously discussed on this platform.

Graphed below is the annual performance of a 60/40 combination of the S&P 500 (SPY) and the Bloomberg Barclays U.S. Aggregate Index (AGG). I have graphed the annual return of a 60/40 portfolio back to the earliest available returns available for the bond component of that portfolio. Last year was the best performance for the 60/40 mix since 1997.

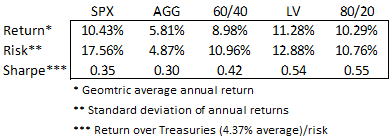

On this blog, I have espoused a tilt towards low volatility equities, and a lower allocation to the fixed income portion of the 60/40 portfolio. To dig into a comparison with the balanced 60/40 portfolio, I used the S&P 500 and the Bloomberg Barclays U.S. Aggregate Index as my representations of equity and fixed income respectively. For Low Volatility stocks, I used the S&P 500 Low Volatility Index, which tracks the performance of the one-hundred lowest volatility constituents of the broader S&P 500.

The table below lists performance figures for the equity index (SPX), the bond index, the 60/40 portfolio of stocks and bonds, low volatility stocks (LV), and an 80/20 portfolio of low volatility stocks and bonds over this long study period. Annual return data dates to 1991, the longest available period of annual returns for my chosen Low Volatility Index.

Even with stocks near all-time highs, the 60/40 portfolio (rebalanced annually in this example) has trailed the standalone S&P 500 by just