I was already in the middle of forming my opinion on Discover Financial Services (DFS) when I read Howard Marks' latest Oaktree Capital Management memo. If you haven't taken the time to read anything by Marks, I would highly recommend it. In the latest memo, the topic of choice was gambling and how it relates to the lovely world of investment.

While reading, one quote stood out in particular, and I believe that several companies in the financial sector meet the mark:

Success in gambling doesn’t go to those who pick winners, but to those with the ability to identify superior propositions. The goal is to find situations where the odds are generous to one side or the other, whether favorite or underdog. In other words, a mispricing.

Well, let's talk about Discover. In my opinion, this company meets both criteria in that it is a winner, and it is mispriced.

Mispricing

The whole financial sector is beat down. Financial services companies trade at 15.7x PE, while the S&P 500 can be had for around 24.7x today.

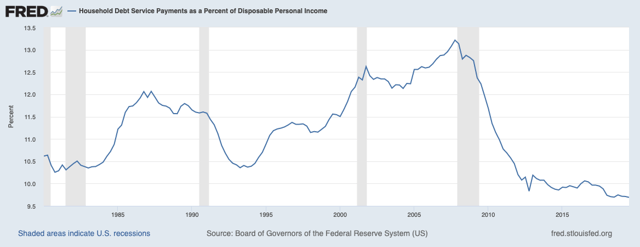

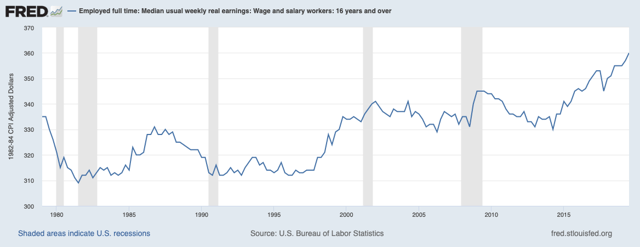

There are many reasons for the industry to be beaten down, but none larger than a recession that many believe is just around the corner. But evidence would suggest that not to be the case. The US consumer is stronger than ever before, with rising wages, plentiful employment, and debt-to-income ratios that haven't been seen in quite some time.

Image: Household Debt Service Payments as a Percent of Disposable Personal Income

Image: Household Debt Service Payments as a Percent of Disposable Personal Income

Image: Median usual weekly real earnings: Wage and salary workers: 16 years and over

Image: Median usual weekly real earnings: Wage and salary workers: 16 years and over

Discover finds itself priced even lower than the financial services average. Trading today for around 9x earnings, you would think the company has no prospects at all, but it is one of the most profitable credit card issuers around.