BlackRock (NYSE:BLK) remains one of a small number of companies in the asset management industry primed for growth, with a number of routes available to achieve organic growth in the retail space, both in the United States and internationally. On the back of another strong quarter, I believe BLK will emerge as a core asset management (AM) position as investors rotating into the AM space will likely view BLK as a bellwether.

Based on a 16.5x multiple on adjusted cash earnings per share (i.e., after adding the discounted value of net cash on the balance sheet), I think BLK could trade up to $600/sh. While some might argue that BLK is pricey given it already trades at a premium to its peer group, I believe the premium is warranted – BlackRock’s above-average growth, in addition to a superior margin profile and record inflows, make BLK a compelling buy.

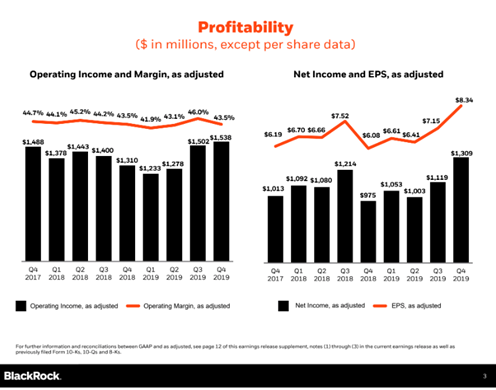

Encouraging Revenue Strength in 4Q Drives Strong EPS

The $4B revenue number posted in 4Q19 was up 16% y/y, as slightly weaker investment advisory fees were offset by outsized growth in performance fees at $239M. Technology/Aladdin revenue also posted strong numbers at $274M, increasing 35% y/y, in part due to the purchase of eFront.

Meanwhile,BlackRock's adjusted operating margin of 43.5% decreased 250bps from 3Q (46%), as total expenses weighed in at $2.4B due to higher general & administration, distribution costs, and compensation costs. Management also guided toward a slightly higher G&A expense base for 2020.

“While we continually focus on managing our entire discretionary expense base, we would currently expect 2020 core G&A expense to increase approximately 5% relative to comparable 2019 levels driven by continued investment in technology and market data, including sustainability initiatives, and the full-year impact of the eFront acquisition.”- Gary Stephen Shedlin, CFO

Source: 4Q19 Presentation

Nonetheless, 4Q19 EPS