Ever since Contango (MCF) merged with Crimson Exploration a few years back, the stock has dropped like a brick. The new management has been attempting to fix the damage done by the previous management.

Those repairs have now attracted the attention of funds managed by T. Rowe Price (TROW). Some will note the sale of stock by the chairman as a negative sign. However, the chairman has purchased far more stock than he has sold. Therefore, some profit-taking is to be expected. He still owns a big chunk of stock and is therefore motivated to see Contango perform much better in the future than it has in the past.

Mismanagement had been the order of the day as Crimson management drove Crimson to the brink of extinction before the merger and nearly did the same to Contango. Now that much of the Crimson management is gone from Contango, investors need to avoid any companies associated with those managers in the future. They have been very unproductive with shareholder money. The new management began with some very productive assets and heavy debt with doubtful chances to refinance.

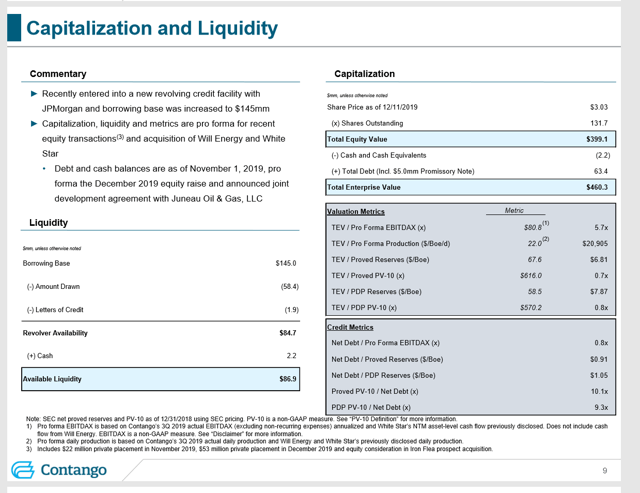

Source: Contango Oil & Gas December 2019 Investor Presentation

The company management has now raised over $100 million in new equity over the last year. The company has now morphed from a heavily indebted company with declining cash flow into an acquiring company of distressed property and one that is now interested in the original offshore business upon which the company was founded back in 1999.

Interestingly, the new management shows very little interest in the properties acquired from Crimson Exploration. Several have already been sold and there appear to be efforts to market much of what is left. Any cash raised from the sale of these properties should further the current expansion program.

I analyze oil and gas companies like Contango Oil & Gas and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies - the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.