The Stone Harbor Emerging Markets Income Fund (NYSE:EDF) is a closed-end fund that invests in fixed income securities of emerging markets including sovereign debt, corporate bonds, and related derivatives. The fund currently has $147 million in total assets and seeks to maximize total returns with a high level of income. Indeed, the fund's distribution yield currently at 15.5% has been a compelling attraction to the strategy. On the other hand, we note that NAV performance has been mixed relative to benchmarks while the fund just announced a cut to its monthly dividend rate as a bearish trend. Also, we think the EDF's exceptionally high premium to NAV near 50% is unjustified, which could narrow and converge lower going forward. This article takes a look at some trends that define our bearish opinion of the fund.

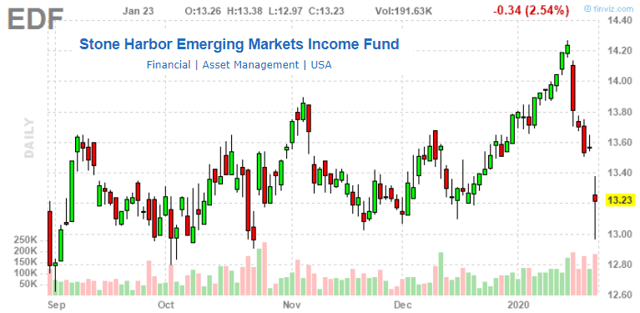

(Source: Finviz.com)

Background

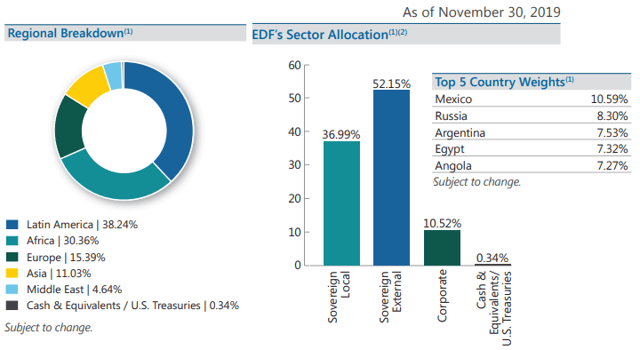

EDF invests primarily in sovereign bonds which represent 90% of the asset allocation. These securities are issued by foreign governments and reflect a country's obligation to repay debt either in local currency or issued in foreign currencies like the U.S. dollar or euro. Based on the latest disclosed holdings, EDF includes exposure to a wide range of emerging markets with a 38% concentration in Latin America while Mexico at 10% weighting represents the largest country exposure. Russia at 8.3% of the fund and Argentina at 7.3% are the next top countries by fund's weighting.

(Source: Stone Harbor)

Generally, this asset class should benefit from positive economic fundamentals of the underlying countries including indicators like GDP growth, external accounts and trade statistics, fiscal balances, and inflationary trends. A weakening dollar and strength in emerging market currencies can also be a bullish driver of returns in the context of credit spreads. We have an overall positive view of emerging markets and think this is an exciting segment but have some