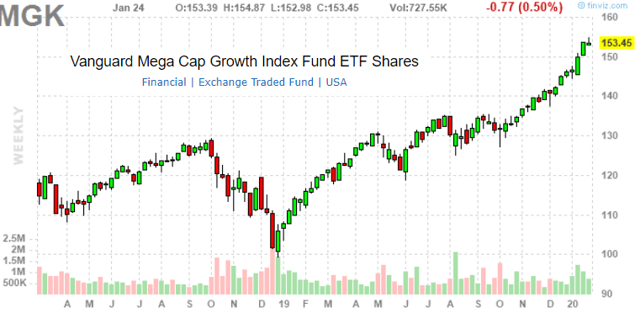

The Vanguard Mega Cap Growth ETF (NYSE:MGK) with $5.7 billion in total assets offers targeted exposure to the largest companies that exhibit the growth style classification. Indeed, while the fund's top holdings include stocks that are widely traded like Microsoft Corp. (MSFT), Apple Inc. (AAPL), and Amazon.com Inc. (AMZN), we highlight some unique advantages of the fund strategy given the diversified non-sector-specific approach. In particular, we think MGK is a good alternative to the Invesco QQQ Trust (QQQ) as it presents a more balanced exposure and potentially lower risk in different market environments. This article takes a look at MGK and why it's worth considering as a core long-term holding.

(Source: finviz.com)

MGK Strategy And Fund Background

The Vanguard Mega Cap Growth Fund tracks the 'CRSP' Index by the same name which classifies growth based on fundamental factors such as historical sales and EPS growth along with forward market forecasts. Mega-cap is defined as the top companies by ranking that cumulatively represent 50% of the total market capitalization across the entire investable universe with a float-adjusted market-cap weighting. The tracking index methodology can be found here.

Naturally, the fund is invested in many of the market-leading high-growth technology stocks which draws a comparison to the Nasdaq 100 (QQQ). Indeed, taking a look at MGK holdings, the top-5 companies including Microsoft Corp., Apple Inc., Amazon.com Inc., Facebook Inc. (FB), and Alphabet Inc. (GOOGL)(GOOGL) are identical to the Invesco QQQ Trust ETF (QQQ) holdings with some differences in weightings. We will use QQQ for comparison purposes throughout this article as it offers some important conclusions on how to best analyze the MGK strategy.

In contrast to QQQ, MGK is a larger fund with 115 current holdings and most importantly is not limited to simply stocks that trade on the Nasdaq as a primary