Allow me to introduce to you a company that maybe got the concept of growing global-scale business while starting to take sustainability topic more seriously, which is currently undervalued due to slowing growth caused by recent shifts in customer preferences and problems with right-sizing its infrastructure. The British success story, an online fashion retailer ASOS Plc. (OTCPK:ASOMY, ASC.L), has been around for almost two decades reaching out for fashion customers in Europe, Asia, and North America. The business has been thriving, but the growth rate has been gradually cooling down thanks to the mature operations in west Europe and increased competition. I think the spirit of the company is still fiery and the brand is strong, thus hidden surprises for investors are still there. The solid financial architecture of the business, ongoing plan for expansion, feasible sustainability goals and leadership in social media support this thesis.

(Source: Company website)

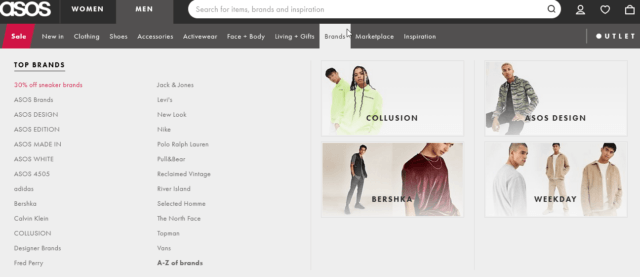

Markets of ASOS

Customers can place orders from almost any country in the world. Accessible shipping, free returns, distribution efficiencies, e-commerce localization (the company usually launches landing pages pre-designed for certain regions), and the overall international online sales strategy have turned ASOS into a truly successful online store. The company offers over 85,000 products from its own collections and other leading brands. ASC started with the idea of getting the clothing people saw in movies or TV shows - for instance, Brad Pit’s red jacket from Fight Club - but soon outgrew this concept and moved on. The company promptly decided that “trend is your friend”, and since then has been able to provide customers worldwide with the latest fashion and best-sellers, putting a lot of energy and money into this strategy. After it seized a dominant position in the UK, it went after the rest of Europe with success. In 2018-2019, ASC heavily invested