Just over six months ago, I wrote the second installment of "Gold Miners Index: The Good, The Bad, And The Ugly" to discuss which miners (NYSEARCA:GDX) were worth holding and which were worth avoiding. Unfortunately, due to a tragic accident for Semafo Gold (SEMFF), and Kirkland Lake Gold (KL) overpaying for its Detour Gold (DRGDF) acquisition, the good miners underperformed the Gold Miners Index since mid-June, as they registered a 12.3% return vs. the Gold Miners Index's 25% return. However, they did their job vs. the bad and ugly constituents, with New Gold (NGD), McEwen Mining (MUX), and IamGold (IAG) combining for a 9.0% return, with McEwen Mining being down 19% in the period. In this article, I will do a more recent update on which names are worth owning and which are probably worth avoiding.

(Source: HackerNoon.com, Author's Photo)

(Source: HackerNoon.com, Author's Photo)

The Good

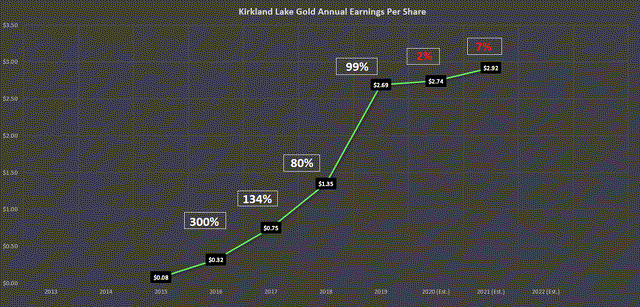

While the bad and ugly haven't changed much as laggards rarely change their stripes, the good group has been shuffled around a little, with Kirkland Lake Gold dethroned from its top spot, giving it up to other major gold producers in the index. The reason for the stock losing its top spot is the lackluster annual earnings per share growth the company will see over the next 18 months, as well as a definite technical change of character vs. the index recently. As we can see in the chart below, annual earnings per share growth will contract from near triple-digit growth in FY-2018 and FY-2018 to low- to mid-single-digit growth in FY-2019 and FY-2020 as the company goes through a transition period absorbing its acquisition of Detour Gold.

(Source: YCharts.com, Author's Chart)

(Source: YCharts.com, Author's Chart)

As I noted, the Detour Gold deal wasn't very accretive short-term to Kirkland Lake Gold's annual earnings per share, as it will see margin contraction and has