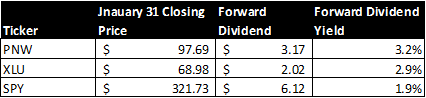

I've previously written about Pinnacle West Capital Corporation (NYSE:PNW) as a quality, pure-play electric utility. PNW is a holding company that has a single primary asset: Arizona Public Service Corporation (APS). While there are some other subsidiaries, they are not functionally material. Since my November 19 article, the stock is up 13.5%, which compares favorably to the SPDR S&P 500 ETF Trust (SPY) and Utilities SPDR ETF (XLU) at 3.6% and 10.6% returns (including the fact that both SPY and XLU have paid dividends) respectively. I believe that its positive fundamentals should help it to outperform the broader market in the near term. However, there is an immediate question as to whether PNW is still a good investment given this recent price appreciation. For income seekers, one can consider that it still offers an attractive forward dividend yield as noted in the below exhibit:

Source: Yahoo Finance, Author Calculations and estimates for forward dividends

Despite Moody's Concerns, Recent Clean Energy Announcement is a Positive Development

PNW's recent announcement that it would achieve 100% clean energy by 2050 resulted in a shift in Moody's outlook. Moody's raised a concern that this target would negatively impact cash flow and increase near-term leverage. While affirming its current credit rating, it shifted its outlook to negative. While the stock posted a small decline that day, PNW resumed its upward climb the next day. PNW's announcement is hardly revolutionary, and furthermore, given Arizona's significant solar resources, an eventual shift to clean energy would be expected. To me, Moody's concerns seem almost irrelevant, and I'll discuss that later. Shifting to 100% clean energy over the next 30 years is not a big challenge. The entire state of Hawaii has mandated a shift to 100% renewables by 2045. Furthermore, the state of New York