MACOM Technology Solutions (NASDAQ:MTSI) is enjoying a mostly undisturbed uptrend, despite many warning signs suggesting a stock price correction approaches. The stock was first picked for DIY Value investing members when it traded in the teens. Since then, the company posted strong first-quarter results and raised its current-quarter revenue and earnings guidance.

With bearish short float at 15.8%, gross margins falling year-over-year, and a net loss, should investors consider taking profits on MACOM stock?

First Quarter Revenue Falls

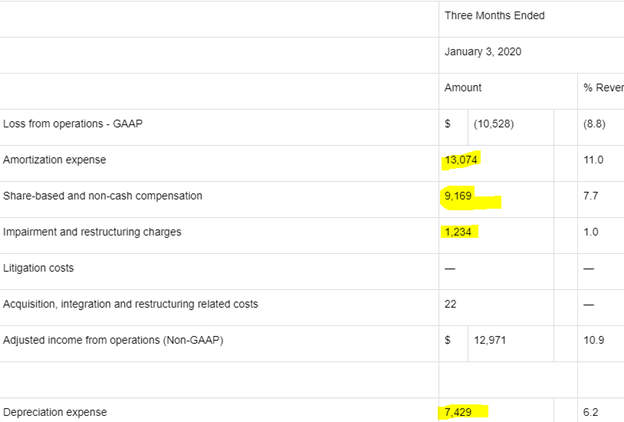

MACOM posted revenue falling 21% Y/Y to $150.7 million. Its gross margin fell from 50.8% last year to 48.9%. Operating losses improved to $10.5 million and better than last year's $14.4 million. The company lost $28.4 million ($0.43 a share) on a GAAP basis. Its non-GAAP reporting excludes amortization expense, share-based compensation, impairment, and depreciation:

Source: MACOM

Markets do not seem mind that the company is excluding major expenses in the non-GAAP number. Instead, the upside guidance is giving the stock a positive lift.

Second-Quarter Outlook

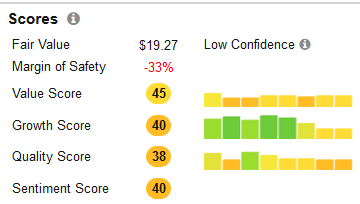

MACOM forecast revenue in the range of $122-126 million. Adjusted EPS will be between $0.09 and $0.13 while the adjusted gross margin is between 53% and 55%. Yet, the scorecard below suggests that the negative 33% margin of safety would endanger investors chasing the stock:

Source: Stock Rover

MACOM's growth rates declined in the last few quarters, so shareholders are holding a lower quality stock at the current share price.

Positives

The company reported a book-to-bill ratio of 1.1 to 1. Solid booking in all three end markets suggests improving demand for its products from here. Notably, 5G product demand led the strength. MACOM reminded investors that:

Our 5G portfolio today consists of receive side RF Front-End Modules, control products for base stations, high-performance analog ICs for 5G front-haul and high-performance coherent driver and TIA products for mid-haul.

Please [+]Follow me for coverage on deeply-discounted stocks. Click on the "follow" button beside my name. Join DIY investing today.