BlackRock

BlackRock (NYSE:BLK) captures a secular growth trend in the 21st century: investors' penchant for investing in ETFs. BlackRock offers many market-beating ETFs, such as the SOXX (SOXX) and IBB (IBB). BlackRock's suite of ETFs offers fantastic mediums through which investors can capitalize on complex trends, such as mankind's forays into space, the growth of artificial intelligence, intelligent cloud computing, and many others.

BlackRock produces the incredibly popular iShares ETFs product line, which many of you have likely seen advertised on Seeking Alpha and publicized on CNBC. You may even own some of their designer ETFs, such as the aforementioned SOXX or IBB. In fact, BlackRock's series of ETFs and asset management products have led the company to being the largest asset manager on earth, with approximately $7.5T of AUM.

The Fixed Income ETF Revolution

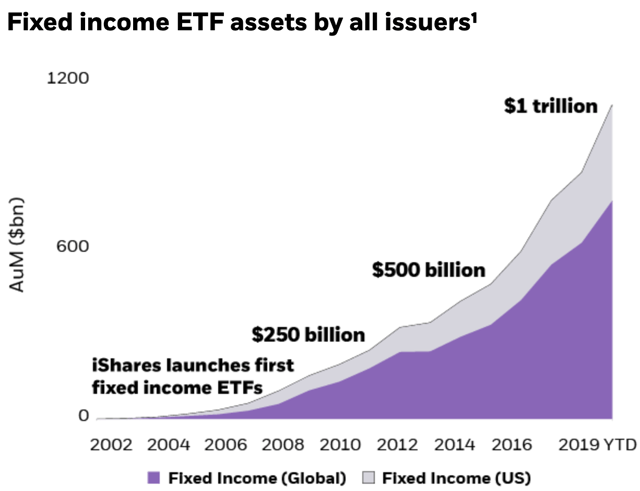

BlackRock has been the beneficiary of a recent explosive trend in the ownership of Fixed Income ETFs.

Fixed income ETF assets have increased eight-fold since 2008 and passed $1 trillion globally this past June; year to date, investors have added more than $200 billion across markets. Fixed income represents one of the fastest-growing ETF segments – a trend we see continuing for some time.

Source: BlackRock Investor Relations

Source: BlackRock Investor Relations

I highly recommend anybody considering investing in BlackRock to check out their website. On it, you will find articles, such as this one, which discuss the technological advancements of asset management, from which BlackRock has been the primary beneficiary.

Valuation (Using The L.A. Stevens Valuation Model)

In my last couple articles, I began using what I call the L.A. Stevens Valuation Model. My name is Louis Alexander Stevens, if anybody was wondering about the name. It consists of three steps:

- Traditional Discounted Cash Flow Model using free cash flow to equity discounted by our (as shareholders) cost