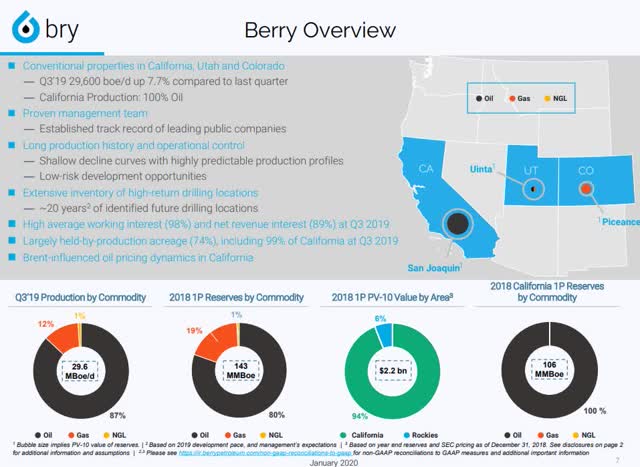

Berry Petroleum Corporation (NASDAQ:BRY) develops and produces oil and natural gas primarily in the Uinta Basin in Utah, the Piceance Basin in Colorado and the San Joaquin Basin in California. This company has a strong balance sheet and it is solidly profitable. It is using this financial strength to further pay off debt, buy back shares, and pay a dividend that yields nearly 7%. One big advantage this company offers is that most of the production it has in California is sold at or near Brent oil prices. At roughly $58 per barrel, it is significantly higher than WTI prices of just around $51 per barrel. This "Brent-influenced oil pricing" and other positives for this company can be seen in the overview shown below:

Source: Berry Petroleum Investor Presentation January 2020

Source: Berry Petroleum Investor Presentation January 2020

The Chart

As the chart above shows, this stock has been volatile. It was trading for around $9 in early November and then rallied up to $11, only to plunge down to around $7 per share after California announced new initiatives on certain drilling techniques. The stock then rebounded sharply as investors realized the pullback was overdone and just about four weeks later, it was back to trading for about $10 per share. But, then it only took another 3 weeks for the stock to pull back to the $7 range due to a drop in oil prices. The recent decline in oil seems to be primarily due to fears that the Coronavirus in China will spread and cause a global economic slowdown. This appears to be an ideal buying opportunity because it looks like this stock is now putting in a bullish double bottom on the chart.

Furthermore, history has shown us that other virus outbreaks are better at creating buying opportunities than they are at causing any significant