I last covered Alexion Pharmaceuticals (ALXN) in October 2018. Since then, much has changed for the pharmaceutical industry as well as the company. Despite the rise in headwinds, I continue to believe in Alexion Pharmaceuticals' growth story. In fact, I believe that this can be an optimal entry point for retail investors to pick up this rare disease player.

Let us see why Alexion Pharmaceuticals is an attractive pick in February 2020.

Alexion Pharmaceuticals continues to post impressive financial performance

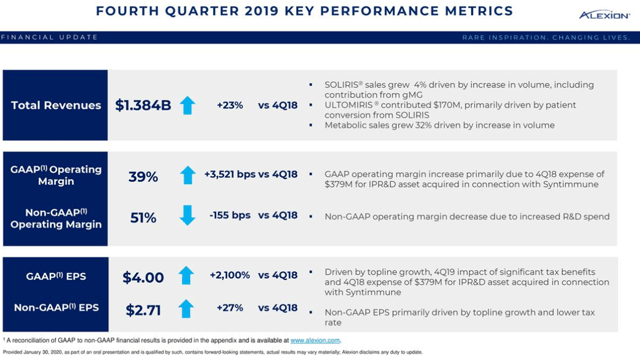

In the fourth quarter, Alexion Pharmaceuticals' revenues rose YoY (year over year) by 22.63% to $1.38 billion and surpassed the consensus estimate by $65.02 million. The company's non-GAAP EPS of $2.71 also beat the consensus by $0.10.

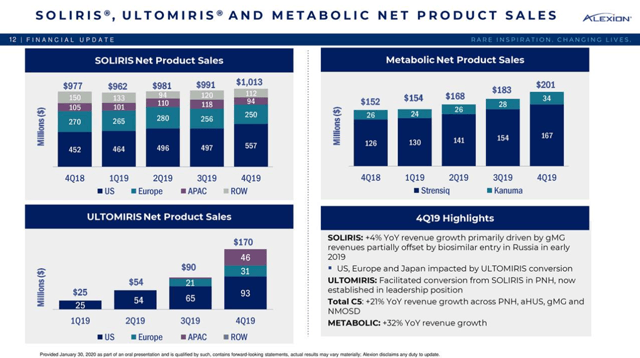

The robust financial performance is attributed to the strength of the company's neurology franchise and rare disease franchises, coupled with successful Ultomiris launch. Revenues have been driven sequentially by patient volume growth mainly in the U.S. and APAC markets.

Soliris managed to report 4% YoY revenue growth, despite biosimilar competition in Russia and increasing conversion of PNH and aHUS patients to Ultomiris. The company is rapidly expanding and diversifying its leadership in the complement inhibitor space.

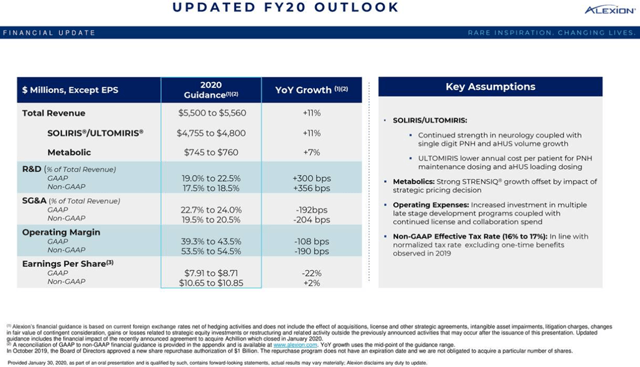

Alexion Pharmaceuticals now expects fiscal 2020 revenues to fall in the range of $5.50 billion - $5.56 billion, lower than the consensus of $5.6 billion. The company has also guided for fiscal 2020 non-GAAP EPS of $10.65 - $10.85, lower than the consensus of $11.37. While investors were unimpressed by the company's soft guidance, the numbers are definitely not bad, considering the industry and company-specific dynamics in 2020.

Ultomiris has already emerged as the market leader in PNH indication

Alexion's flagship product, Soliris, is scheduled to lose its composition of matter patent in the U.S. in 2021. To avert the sudden dip in revenues, the company has been