Trillium Therapeutics (TRIL) is a biotech that should be on everyone's radar. There are several reasons to be highlighted below, but one main reason is because the mechanism of action of targeting CD47 has been proven by a peer. This target involves the next generation of checkpoint inhibitor therapy. Based on this potential alone, Trillium should be valued equal to if not higher than its equivalent biotech. Besides the CD47 products, it boasts a 2nd generation STING agonist. Lastly, it had already raised $117 million just the other week. That means no near-term risk of a cash raise. Based on all these prospects, I believe that Trillium is significantly undervalued.

"Eat Me" And "Don't Eat Me" CD47 To Be Next Generation Checkpoint Inhibitor

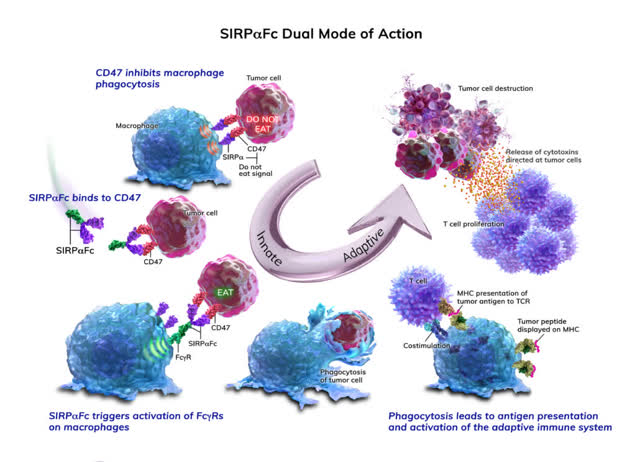

What makes Trillium such a strong biotech is the latest craze in the sector, with the target being CD47. First, it's important to start off with the premise or mechanism of action and why so many biotechs are looking at this sector. What happens is that cancer cells have a CD47 blockade known as "Do Not Eat Me" signal. This signal basically blocks the macrophages in the immune system from being able to detect these cancer cells and destroy them. Trillium has two products that go after the blockade of the CD47 signal and they are:

- TTI-621

- TTI-622

Why the need for two CD47 products? That's because while both have the same mechanism of action in a way, each one provides a different level of strength.

Source: https://trilliumtherapeutics.com/science/

Compared to all peers in the space, Trillium is the only one that has a CD47 product that has the IgG1 Fc region. This drug is known as TTI-621 shown above. TTI-622 has the IgG4 Fc region. Both of these products developed by the biotech use SIRPa Fc fusion proteins linked to

This article is published by Terry Chrisomalis, who runs the Biotech Analysis Central pharmaceutical service on Seeking Alpha Marketplace. If you like what you read here and would like to subscribe to, I'm currently offering a two-week free trial period for subscribers to take advantage of. My service offers a deep-dive analysis of many pharmaceutical companies. The Biotech Analysis Central SA marketplace is $49 per month, but for those who sign up for the yearly plan will be able to take advantage of a 33.50% discount price of $399 per year.