Phoenix #3: The Chemours Co (NYSE:CC)

Chemours is a company struggling with much effort against slowing growth in its targeted industries, including fluorochemicals and titanium dioxide. Yet from a value perspective, the stock is undervalued. While the company’s average EBITDA/EV (my favorite value metric) has been below the market average most of the decade, it is now at an undervalued number, 0.14, which presents a convex* payoff curve over earnings periods, as per my research on earnings trading.

The stock is obviously underperforming the market, but I believe the market is giving the company unfair pressure due to the various lawsuits in which CC is active and due to the perceived danger for the juicy 6% dividend yield. The latter issue is overblown, in my opinion, as dividend payouts have been quite conservative thus far (41% of earnings); some aspects relating to the legal issue can be a bullish catalyst, should CC succeed in its lawsuit against DuPont (DD). It seems investors are beginning to realize this, and we are seeing increasingly strong support levels between $15 and $17.

The technical positioning looks good. The support levels can create a pause in the drawdown that might have begun on Friday. And the longer-term trends are clearly bullish, whether you look monthly or quarterly.

My backtests show a reasonable price target between $21.50 and $23 should CC rally. The downside is much weaker, with a selloff unlikely to bring the stock lower than the high $15s. The risk/reward clearly favors the bulls here.

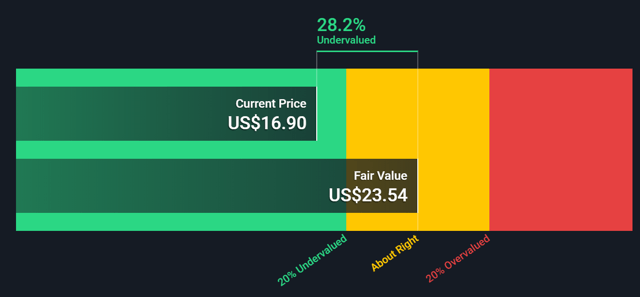

The discounted cash flow valuation agrees with my backtests’ numbers above. In fact, standard discounted cash flow analysis produces a fair value higher than my price target range:

(Source: Simply Wall St)

The possibility of a short squeeze is rising as shorts increase. We often see excessive rallies when

Exposing Earnings is an earnings-trading newsletter (with live chat). We base our predictions on statistics, probability, and backtests. Trades are recommended with option strategies for the sake of creating high-reward, low-risk plays. We have 89% accuracy for our predictions in 2019.

-Upcoming Earnings Plays: AZO, ORCL, MU, CAMP, LQDT

Check out my methodologies in these four videos.

If you want:

- A definitive answer on which way a stock will go on earnings...

- The probability of the prediction paying off...

- The risk/reward of the play...

- A well-designed options strategy for the play...

...click here to see what Exposing Earnings members are saying.