Tencent Music Entertainment Group (NYSE:TME) has had a rough year with a probe relating to anti-trust concerns which was later dropped, and slowing user growth and decline in gross margins as content costs increased. However, since shares have taken a beating, valuations have come down and offer a buying opportunity as the company is starting to see acceleration in music subs and also the ratio of paying users.

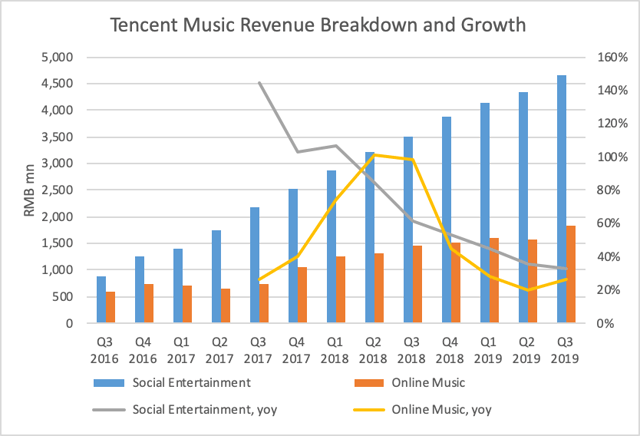

The bulk of the revenue still comes from social entertainment but online music is beginning to pick up

Social entertainment revenue still accounts for more than half of total revenue. In 3Q19 social entertainment revenue increased by 32.9% to RMB4.66 billion (US$652 million) from RMB3.51 billion in 3Q18. This was primarily driven by revenue growth in both online karaoke and music-centric live streaming services.

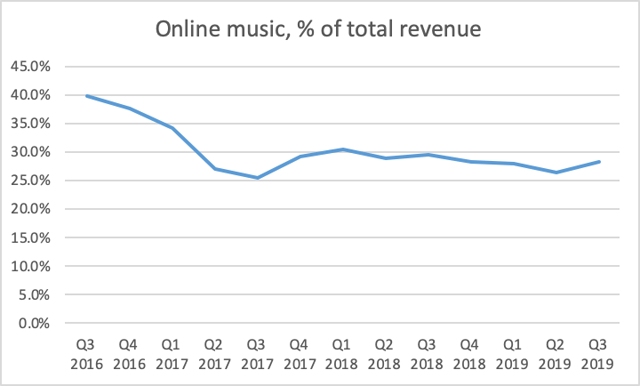

Online music services for in 3Q19 increased by 26.2% to RMB1.85 billion (US$258 million) from RMB1.46 billion in 3Q18. The increase was driven by robust growth in music subscriptions and sales of digital music albums but offset by a decrease in sublicensing revenues from other music platforms (Netease, Xiami etc).

Music subscriptions revenue reached RMB942 million (US$132 million) in 3Q19, a 48.3% increase from RMB635 million in 3Q18, owing to improved paying user retention rate and overall paying user growth. Music subscriptions revenue is about 51% of this segment, improving from about 43% in 3Q18.

Source: Bloomberg, Himalayas Research

Source: Bloomberg, Himalayas Research

MAU growth is still light but converting into paying users has been key

Owing to increased competition and a maturing market, the company is having trouble growing its platforms. Competing short video platforms like Tik Tok have been capturing more user time spent (particularly in lower tier Chinese cities where the company is struggling in) and have also been aggressive in their revenue sharing with performers. However, improvement in the WeSing