Preferred equity investments have grown in popularity over the past few years as income-seeking investors search for high-yield assets in a very low-yield market. Most preferred equities trade at yields of 5-6% or greater which is far better than investors will find in the bond market and even among most "high dividend equities."

Of the major preferred equity funds, the Global X U.S Preferred ETF (NYSEARCA:PFFD) is one of the best as it has the lowest expense ratio of 23 bps and has generally outperformed its peers. This can be seen below when compared to the Invesco Preferred Portfolio ETF (PGX) and the iShares Preferred and Income Securities ETF (PFF):

As you can see, PFFD is the winner by a slight margin. Frankly, the majority of investments and exposure is the same for each of the ETFs, but PFFD's expense ratio is 20-30 bps lower, so it tends to outperform.

Like most Global X yield-oriented ETFs, PFFD pays its dividend monthly at a rate of $0.114 per share. At a price of $25.5 today, this corresponds to a compounded yield of 5.5%.

In my opinion, PFFD is the best preferred equity ETF of the bunch, but it may not be a great time to buy the fund. With interest rates re-touching an all-time low and inflation signals on the rise, fixed-rate funds like PFFD could suffer significant devaluation. As I'll explain, If investors are looking for more stability, they may be best off looking into floating-rate investments.

A Look at PFFD's Exposure

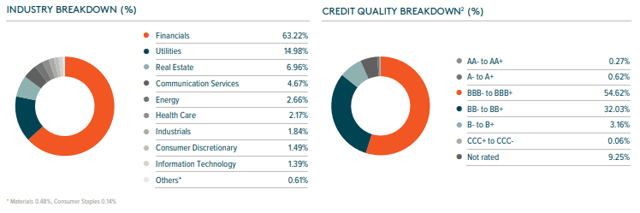

Like most preferred equity funds, PFFD has very high exposure to the financial sectors since banks tend to issue more preferred equity than others. This and the credit quality of its holdings are illustrated below:

(Global X)

As you can see, the fund has high exposure to financials, utilities, and real