The sudden 8-day meltdown in Travel and Leisure stocks affords investors an opportunity for long-term investments in great companies at bargain prices. Some of these blue chips have fallen to a multi-year low from 52-week highs in a matter of days. Although the travel fundamentals for these companies have been altered, they have not been inexorably changed. People will soon be traveling again - as much as they did before.

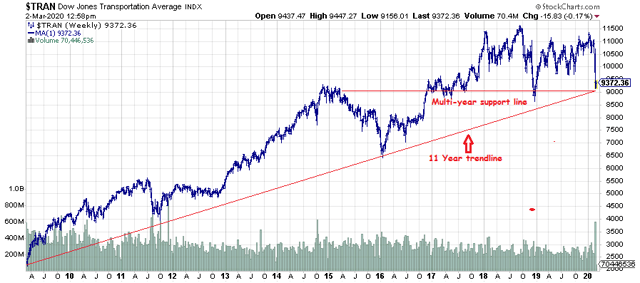

The Dow Jones Transportation index is showing strong support at its current levels.

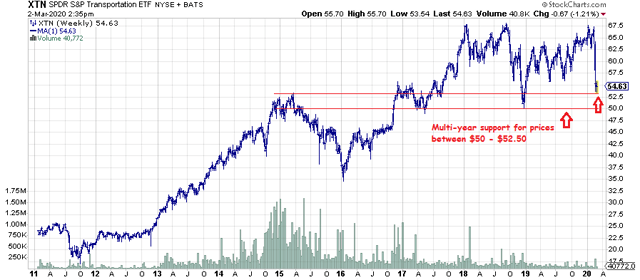

There is solid multi-year support for the S&P Transportation index (XTN), now -22% since its high on 2/20, just 12 days ago. Airline stocks comprise 26% of its holdings. Below are their ticker symbols and, if available, links to earnings news. Most of the recent reports were very positive.

Allegiant Travel Company - (ALGT), Alaska Air Group Inc. - (ALK), United Continental Holdings Inc. (UAL), Delta Air Lines Inc. (DAL), Southwest Airlines Co. (LUV), Spirit Airlines Inc. (SAVE), American Airlines Group Inc. (AAL), SkyWest Inc. (SKYW), JetBlue Airways Corporation (JBLU), and Hawaiian Holdings Inc. (HA).

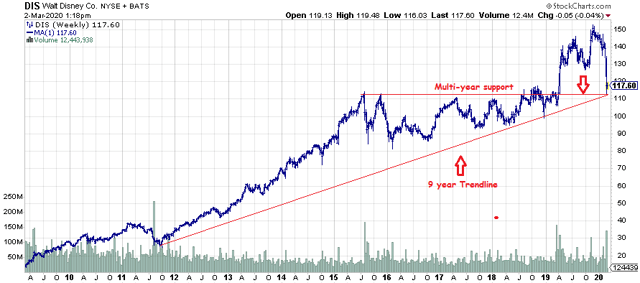

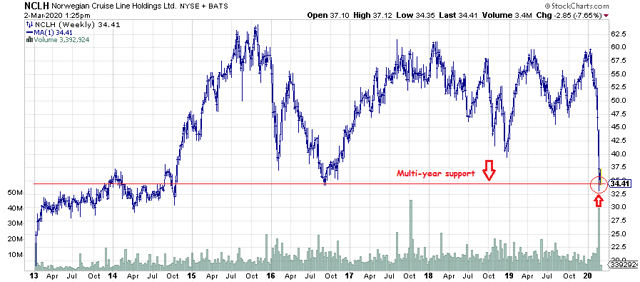

Below are some select stocks for consideration based on their technical configurations.

Disney (DIS), approximately 22% below its December 2019 highs.

Norwegian Cruise Lines (NCLH), 43% below its January 12, 2020 highs, down today (3/2) by as much as 8% to a new 5-year low.

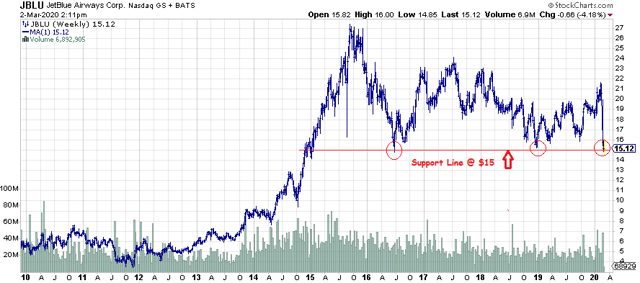

JetBlue Airways, 31% below its February 13, 2020 highs.

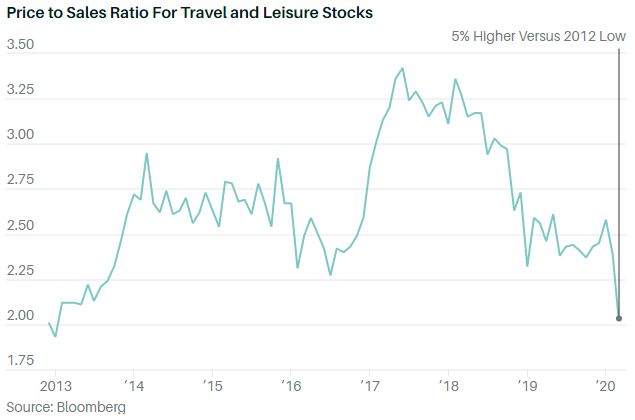

The price-to-sales ratio for this sector is only slightly higher now than its 2012 lows. A low price-to-sales ratio means investors are paying less for each unit of sales.

Market news outlets are alerting investors to the bargain prices arising in this sector.

- See: Opinion: The Corona virus has sunk cruise line stocks - now it’s time to buy them, by Philip van Doorn, March 2, 2020.

- Travel