What an interesting few weeks it's been for investors.

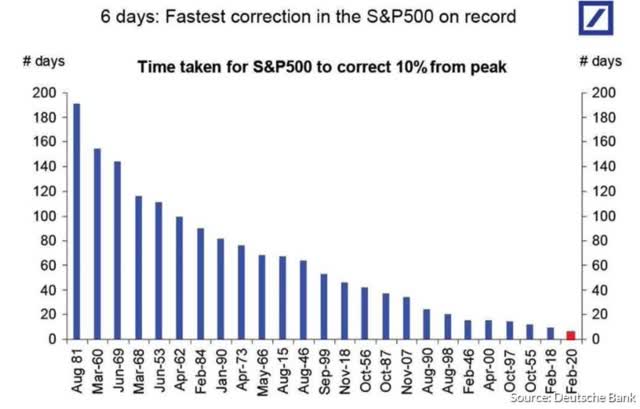

Outside of single-day corrections (like Oct 19th, 1987 when S&P fell 20% in a single session), we've seen the fastest correction since the Great Depression.

That included an 11% decline in the S&P 500 and a 13.6% crash in the Dow during the final week of February. That was the worst week since 2008 and the 5th worst of all time.

Then on Monday, global central banks came out and said they would slash rates and provide "ample liquidity" to avert or at least mitigate a recession caused by the COVID-19 virus. That sent stocks up 4.8%, their best one day gain since 2008.

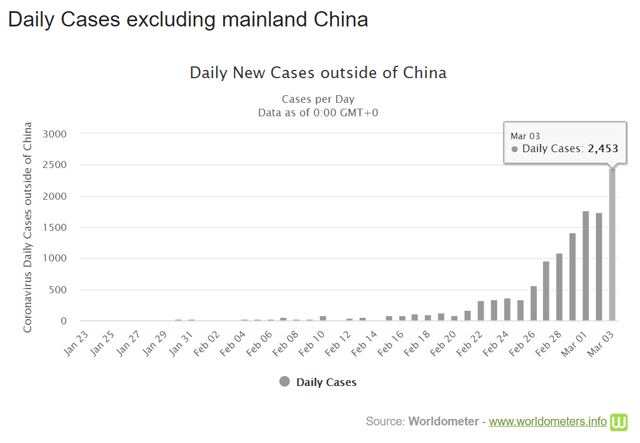

The bad news is that with 94,301 cases in 82 countries, this is now a pandemic that has escaped initial hopes of early containment.

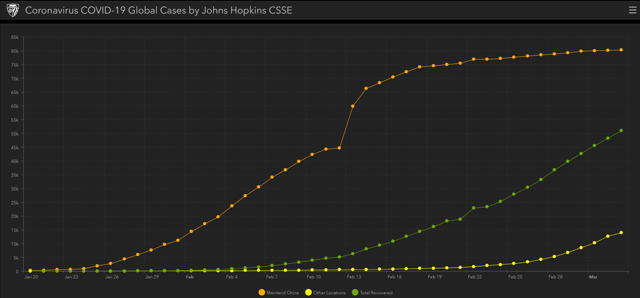

The good news is that, as seen by China's daily new cases falling to a steady 100 per day in the past week, the COVID-19 virus is NOT a doomsday bug that will likely sweep the globe and kill millions.

(Source: Johns Hopkins) orange = China cases

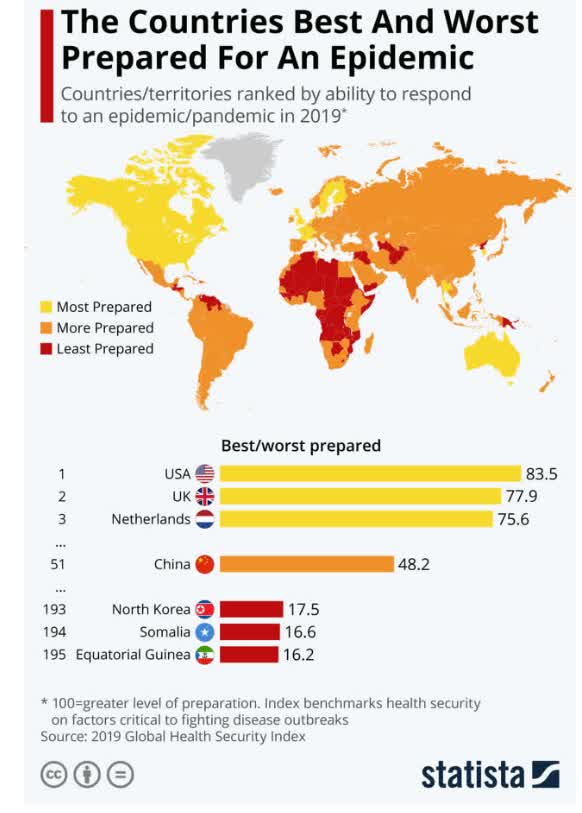

China was the 51st most prepared country in the world for an epidemic according to a study by Johns Hopkins.

Yet even in Wuhan, where this outbreak began, Just 1 in 10,000 people have contracted the virus.

Yet even in Wuhan, where this outbreak began, Just 1 in 10,000 people have contracted the virus.

Of course, that doesn't mean that the global economy won't feel a short-term impact from this. Already over 220 S&P 500 companies have warned that supply chain disruption and lower demand from overseas (mostly China itself) will impact Q1 and thus 2020 earnings.

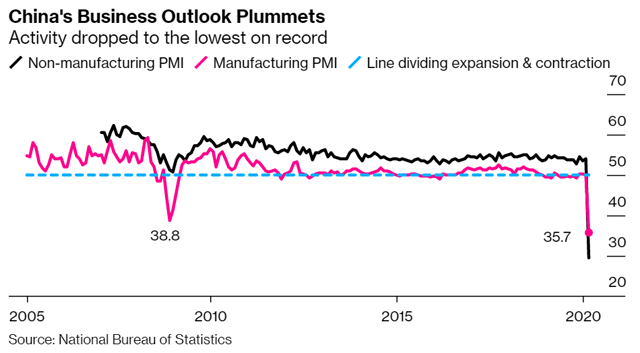

China's efforts at containing the outbreak, which appears to be succeeding, involved quarantining 60 million people and placing travel restrictions on 600 million.

(Source: Bloomberg)

The result of basically shutting down the country for

---------------------------------------------------------------------------------------- Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List reference/screening tool. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List reference/screening tool. Membership also includes

- Access to our four model portfolios

- 30 exclusive articles per month

- Our upcoming weekly Podcast

- 20% discount to F.A.S.T Graphs

- real-time chatroom support

- exclusive weekly updates to all my retirement portfolio trades

- Our "Learn How To Invest Better" Library

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.