General Dynamics (NYSE:GD) is primarily known as a producer of defense equipment. The company has an aerospace division, combat division, marine division, information technology division, and a mission systems division. Each one complementing each other in enhancing technology and offerings to provide superior products. As a producer of military equipment, the company benefits from strong defense budgets and awarded military contracts. However, the stock can be swayed if the defense budget is viewed as being cut. While some investors would consider the stock an industrial, I consider it less so due to the need for its products no matter the economic state of the country. As the shares trade closer to their 52-week lows, I believe now is the time for investors to add some to their portfolio.

Performance

General Dynamics recently reported earnings that beat on both the top and bottom lines.

Source: Seeking Alpha

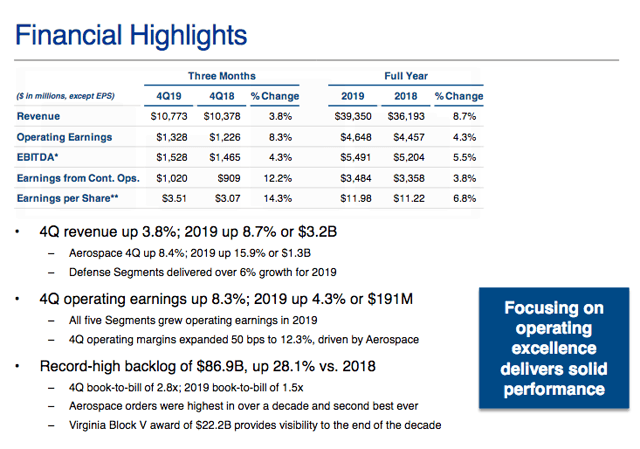

The company saw growth in every operating segment showing it can continue to produce results. Earnings per share increased 14% from the prior year. Quite a nice number. "Aerospace" saw growth of 8.4%, "Combat Systems" saw a nice increase of 13.1%, "Information Technology" saw revenue grow a slight 1.9%, "Mission Systems" grew 2.5%, and "Marine Systems" saw a nice gain of 11.7%.

Operating margins continued to expand which helps drive profitability growth faster than revenue growth.

Source: Earnings Slides

These strong results would usually lead a stock to new highs and certainly create strong stock performance. The company is seeing growth of high double digits, thanks to many contract wins and a strong backlog. In fact, the backlog is a record $86.9 billion. This type of consistency and order log gives the company confidence in the future. This allows management to use its strong free cash flow to enhance shareholder returns.

As the