(Source: Pexels)

CatchMark Timber Trust (CTT) is a REIT that owns 1.5 million acres of Timberland located in eight states in the U.S. Southeast and Pacific Northwest. This includes 435K in wholly owned acres (18.6 million tons of inventory) and 1.1 million (44 million tons of inventory) in joint venture acres.

On paper, the company has been in a slightly difficult situation over the past year due to a substantial $55 million loss from its "Triple T" joint venture last year. While this loss drastically hurt the company's EBITDA, its more important cash flow from operations has been stable. While the company is in a risky situation regarding the leverage involved in the joint venture transaction, it is cheap and offers a high 6% dividend that will likely rise with timber prices.

On that note, the fundamentals supporting timber remain strong despite the broader market sell-off. Building permits continue to boom, as do new home sales. While a recession is certainly possible, the property development market will continue to be supported by exceptionally low vacancy home rates and even lower mortgage rates. This gives credence to lumber future's current bullish trend, which is likely to support a fundamental turnaround for CatchMark.

A Look at Timber and Lumber Fundamentals

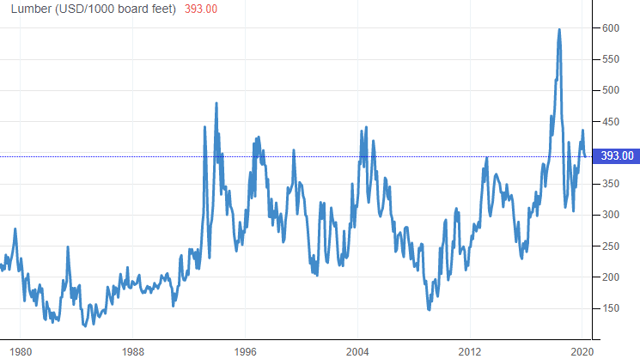

The primary use of timber is construction. However, other uses include pulp & paper, furniture, and synthetic textiles. Importantly, most of its uses make the demand for it highly cyclical. This is demonstrated in the long-term lumber price chart below:

(Source: Trading Economics)

As you can see, lumber remains at the top end of its long-term chart but still far below its 2018 peak. Zooming in, we can see that it is at the bottom of its channel on a solid positive trend:

(Source: Trading Economics)

The recent selloff in timber prices

Interested In My More-Exclusive Research?

My fellow contributor BOOX research and I run the Core-Satellite Dossier here on Seeking Alpha. The marketplace service provides an array of in-depth portfolios designed using the academically-backed Core-Satellite approach. This involves creating a base long-term portfolio (the core) and generating alpha using unique well-researched short-term trades (the satellite).

As an added benefit, we're allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they'd like. You can learn about what we can do for you here.