Welcome to the market craze edition of Natural Gas Daily!

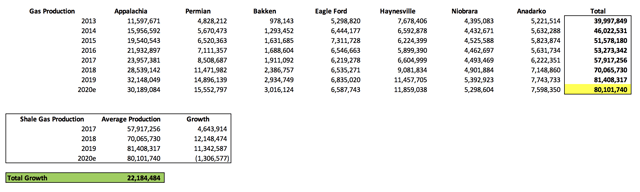

The near-term oil price war will benefit the natural gas market as US oil production will exhibit a drastic decline in Q2 2020. With associated gas production ballooning throughout 2018 and into 2019, the US natural gas market became overwhelmed by the surging supplies pushing prices down to $1.7/MMBtu.

Since 2016, associated gas production has ballooned from 25.44 Bcf/d to 37.802 Bcf/d in 2019.

In 2019, Lower 48 gas production averaged 91.41 Bcf/d, which means that associated gas production accounted for 41.35% of total gas production.

In our base-case scenario at the moment, we assume WTI rises back above $50/bbl in H2 2020. This would echo a production decline in US oil production from 12.78 mb/d at the end of 2019 to 11.775 mb/d to the end of 2020.

In this scenario, we have US natural gas production declining year-over-year by 1.3 Bcf/d year-over-year.

Source: EIA, HFI Research

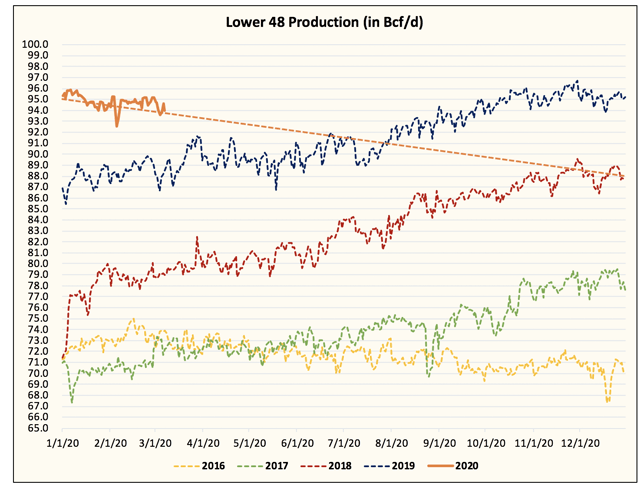

But keep in mind that because lower 48 gas production averaged ~91.41 Bcf/d in 2019, that implies the 2020 average to be ~90.1 Bcf/d.

With lower 48 gas production at 93.9 Bcf/d today, this implies a y-o-y decline to ~88 Bcf/d by the end of the year.

Most of the decline will actually be from Appalachia with a drop of ~2 Bcf/d. Associated gas production might actually be flat under this scenario.

But the supply-demand implications with lower 48 gas production at ~88 Bcf/d is unthinkable.

Given the balancing point for the US natural gas market is at ~94.5 Bcf/d today, this implies a fundamental supply-demand deficit of 6.5 Bcf/d. Something will have to give under this scenario:

- Either demand destruction is created via very high natural gas prices or...

- Supply needs to respond right away.

But given associated gas production

For readers that have found our natural gas articles insightful, we think you should give HFI Research Natural Gas a try. We provide the following to subscribers:

Come and see for yourself why we are the largest natural gas community on Seeking Alpha.