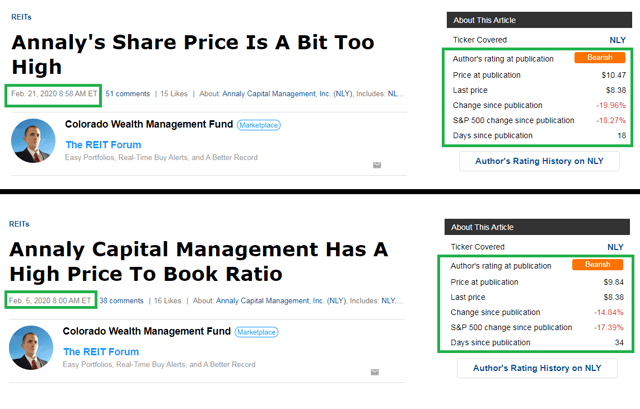

Annaly Capital Management (NYSE:NLY) plunged. Shares took a massive beating over the last few weeks. We warned investors about the risk:

Source: Seeking Alpha

That's two public articles in February warning investors. As we predicted, the price-to-book ratio declined.

Don't get me wrong, book value is down since the middle of February.

However, the price plunged dramatically more than the projected change in book value.

Of course, some investors don't want to save money. Rather than appreciate our analysis, they write:

These "nly" is overpriced articles get old. Really nothing but shameless touting for his newsletter.

Fortunately, most investors still appreciate the analysis. We appreciate you spending your time reading our article. If you followed our "shameless touting", you protected your portfolio from losing 20%.

For comparison, our portfolio is down 6.13% since 2/20/2020. We're not exempt from declines in this market, but our losses are dramatically smaller.

Dividends

At the time of our latest article on NLY, the dividend yield was 9.5%. To make up for the loss in share price, investors will need more than 2 years of dividends.

No More Bearishness

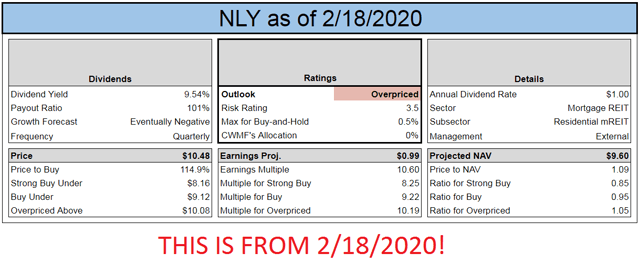

In our last NLY article, this was our index card:

Source: The REIT Forum

When shares were $10.48 and trading at a price-to-estimated book value ratio of 1.09, being bearish was 100% the right call.

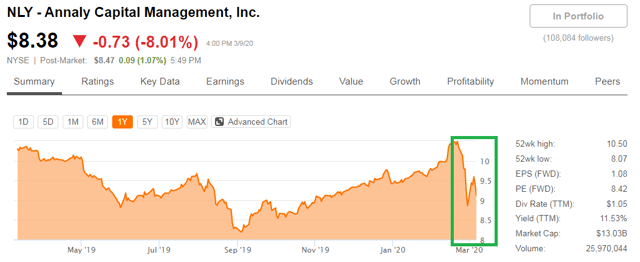

So, why aren't we bearish anymore? Because the share price is $8.38 instead of $10.48. That's a very material difference:

Source: Seeking Alpha

Fundamentals got hurt, that's true. The plunge in interest rates was not favorable. Huge changes in interest rates are not favorable.

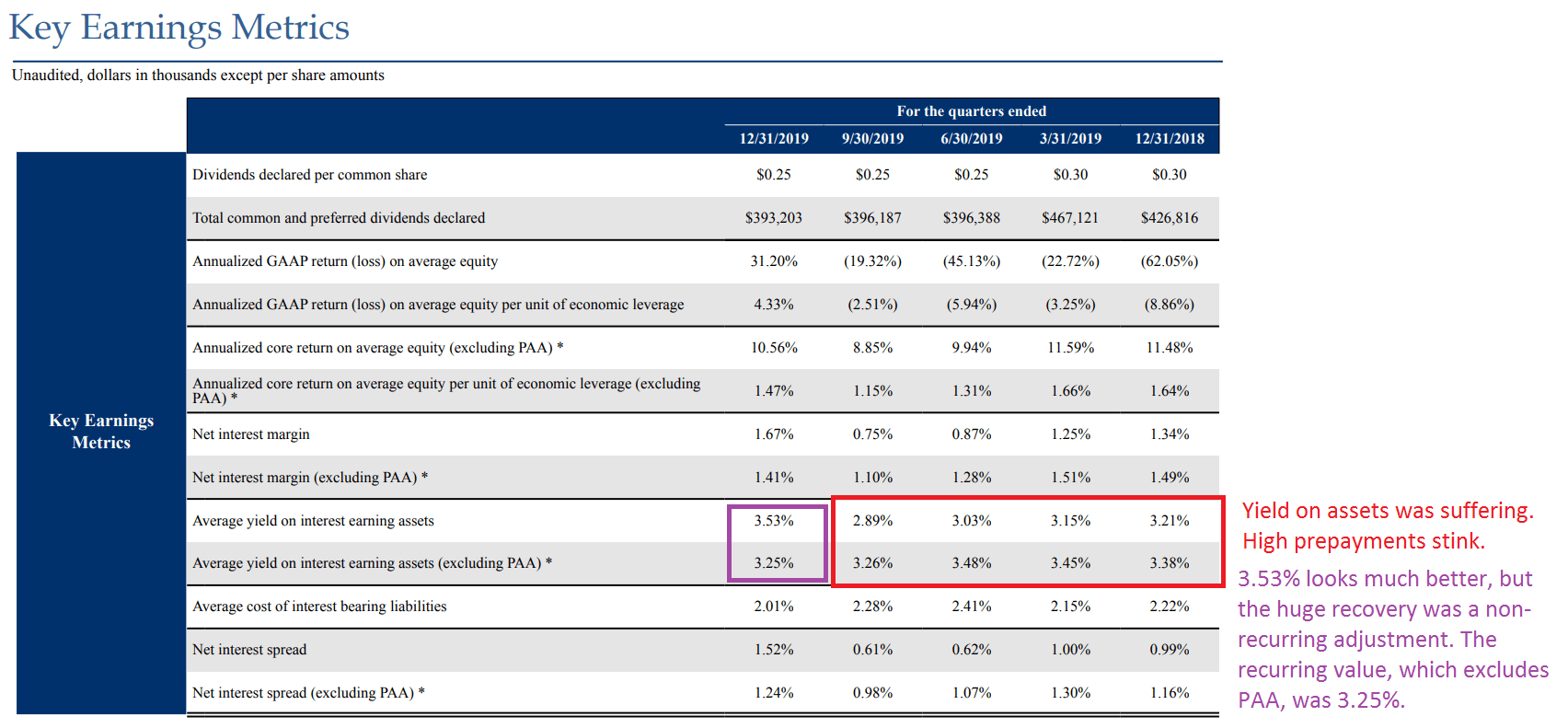

The plunge in the 10-year Treasury created a plunge in mortgage rates. The drop in mortgage rates increased prepayments. The higher level of prepayments reduces the yield on assets:

Source: NLY

See how falling mortgage rates had a negative impact? It weakened the average yield on interest-earning assets (excluding PAA).

PAA stands for Premium Amortization Adjustment. Going into the advanced math is beyond the scope of this article. You can simply know that the yield excluding PAA is generally more important.

Expectations for higher amortization expense (and thus lower yields on assets) are driving shares of NLY dramatically lower. This was a factor we could see coming, though we didn't expect Treasury rates and mortgage rates to fall this far.

Regardless, the time for being bearish was in February. Today, they might go down or they might go up. In February, the deck was stacked against investors by an absurdly high price-to-book ratio which left virtually zero margins for error.

Preferred Shares

NLY's common stock isn't the investment we want to highlight right now. We're mentioning it enough to end our bearish rating. However, we want to focus on lower-risk preferred shares.

We’ve been in and out of NLY-I (NLY.PI) a few times, and it’s delivered exceptional returns each time. We like it because it carries a low-risk rating, has several years of call protection, a reasonable yield, and a reasonable floating rate after call protection ends.

We found the NLY preferred shares are significantly more attractive than most of the sector. Among the NLY preferred shares, we often like NLY-I best.

Compared to NLY-F (NLY.PF), we like NLY-I’s additional call protection.

Compared to NLY-G (NLY.PG), we like NLY-I’s higher floating rate.

Following the recent declines in share prices, NLY-F is also very attractive.

Annaly Capital Management Series I Preferred Share

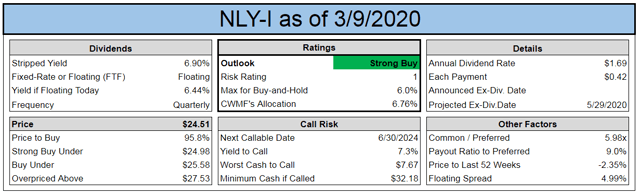

See the index card for NLY-I:

The yield to call of 7.3% isn’t too bad. If investors hold the shares and get called when call protection ends, it isn’t a disaster. Not even close. Most would prefer to have the shares remain outstanding, but we like to keep a close eye on the risk.

If shares were floating today, the coupon rate would be lower. We can live with that. When the floating rate actually kicks in, starting 6/30/2024, the short-term rates might be higher or lower.

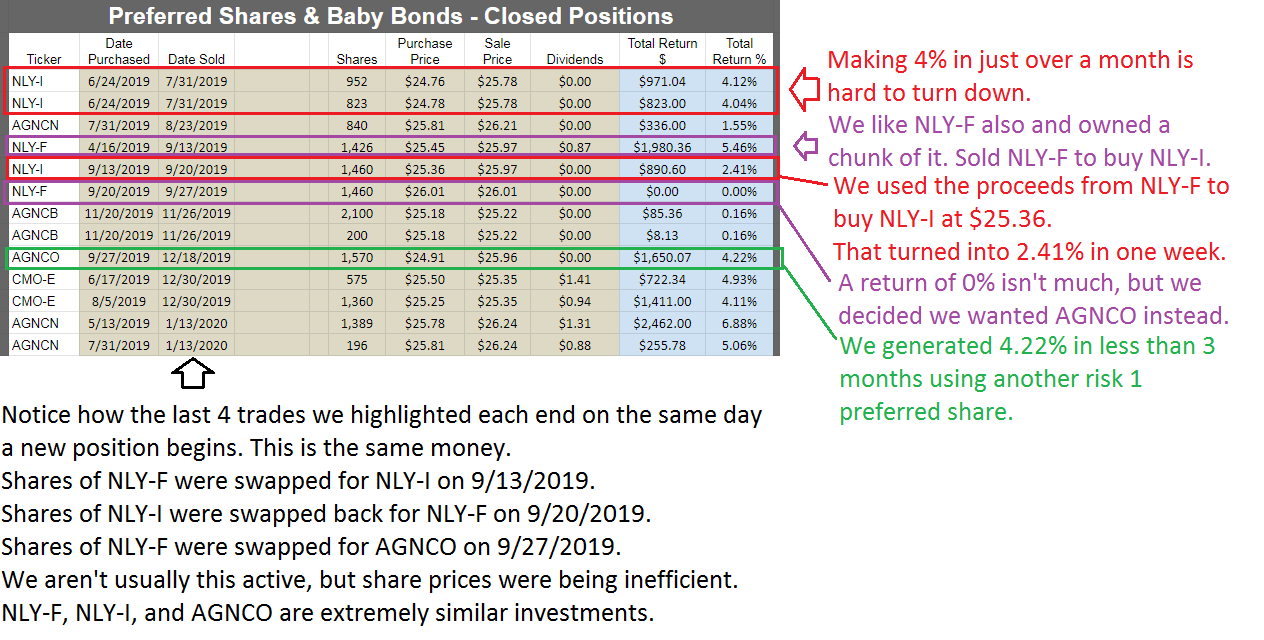

So far, NLY-I has treated us very well. We’re demonstrating that by showing all of our latest “Closed Positions” in preferred shares:

Source: The REIT Forum

We have 3 entries for NLY-I. The top two trades covered the same dates but were entered separately because they were in two different accounts with slightly different purchase prices. Investors building a long-term portfolio for income should be looking at the NLY and AGNC preferred shares as cornerstones for the portfolio.

So, why do we trade them? Because the cumulative returns from 4/16/2019 to 12/18/2019 came out to 12.09%.

That isn’t annualized. We aren’t even compounding it.

That’s simply 5.46% + 2.41% + 0.00% + 4.22% = 12.09%. Not bad for 8 months, huh?

Remember, we focus on these shares because they are unique for their exceptionally low risk. Consider the chart for NLY-F as a way to evaluate the risk:

Source: Yahoo Finance

The difference between the highest and lowest prices was about 4% during that time (from 4/16/2019 through 12/18/2019). The volatility would be even lower if we accounted for the first dip being on an ex-dividend date.

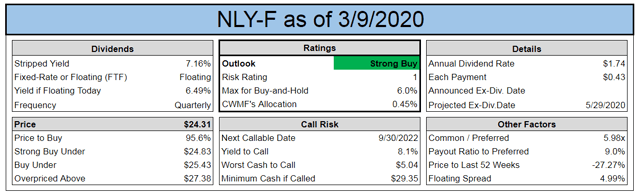

Annaly Capital Management Series F Preferred Share

Another good choice is the series F preferred share. We highlight it with the index card below:

The yield to call is 8.1%. Just try to complain about an 8.1% yield to call in this environment. If shares aren't called, investors are earning 7.16% on their money. When the floating rate kicks in, the shares pay 4.99% over the relevant short-term rates.

Sector Outlook History

On 2/5/2019, in a subscriber article, we wrote:

We track the stripped price history across the mortgage REIT preferred shares we cover. Some of those shares have already been called. Among the shares which remain outstanding, we calculate the current stripped price to the average stripped price going back to September 2018. Measurements are taken about once per week.

As of February 9th, 2020, on average stripped prices are 3.01% higher than their trailing average.

In the same article, we concluded:

While a 3.01% premium across the sector already sounds pretty high, the measurement also includes shares which were just issued and have only 2 weeks of price history. Those shares are usually trading at much smaller premiums.

When we see the current stripped prices being much higher than their trailing averages, we expect to have far fewer bullish ratings.

At the time, we had 2 buy ratings, 18 "overpriced" ratings, and 24 "hold/neutral" ratings.

Two weeks later, on 2/23/2019, we wrote:

Preferred shares throughout the sector still trade at a substantial discount to their average values from the last 18 months. However, the premium shrank a little over the last two weeks. How do you avoid paying a big premium? Focus on the lower risk shares. They haven’t rallied as far because they don’t fall as far when things get ugly in the sector.

Finally, on 3/8/2019, in Preferred Shares Week 194, we wrote:

We couldn’t know how ugly things were about to get, but the strategy of emphasizing low-risk shares was still a winner. As it stands, the low-risk shares are still too cheap relative to higher-risk options.

While shares trade at a 3.01% premium to their average stripped prices in early February, they trade at a 3.7% discount to average stripped prices today.

As a reminder, the stripped price is the current share price minus the amount of dividend accrued so far. If we didn't adjust for dividend accrual, this metric wouldn't be as useful.

We finally have a large volume of bullish ratings on preferred shares again. We haven't been this spoiled for choice in over a year.

Conclusion

The horrendous pricing in Annaly's common shares is gone. We have consistently maintained that we would go to neutral when the price-to-book ratio was corrected. We're following through. The bear call is over. Beware, momentum in the sector still looks absolutely terrible, and we believe book value is lower today than it was in February.

While we're ending the bearish rating on common shares, we're also highlighting a bullish outlook on the NLY preferred shares.