About two weeks ago, the German pharmaceutical and life science company Bayer AG (OTCPK:BAYZF) (OTCPK:BAYRY) reported full-year results for 2019 and the numbers were solid. When we go back about a year – the time I wrote the article “Bayer: A Life Science Company Fighting For Its Life” – the headlines were dominated by the acquisition of Monsanto and the following lawsuits. The stock price was really under pressure at that point and trading close to €50.

(Source: Pixabay)

Right now, Bayer’s stock price is trading very close to the 2019 lows again – with the slight difference, that it is not the lawsuits, but the global panic about COVID-19 and the potential economic consequences that are sending stock prices down. We will take the chance to take a closer look at the company, which led the list of the most valuable companies in Germany until a few years ago.

2019: Solid Results

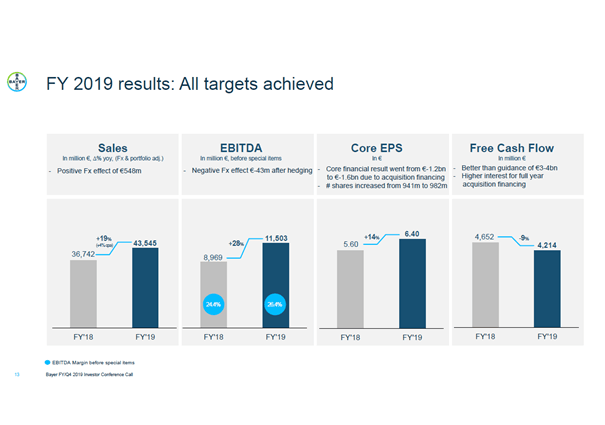

When looking at the stock price of Bayer during the last five years, one has to expect the worst. Against this background, the reported results for 2019 are quite solid and a positive surprise. For the full year, sales increased 3.5% to €43.5 billion (when using the portfolio as well as FX adjusted numbers, which makes sense). According to reported numbers, sales increased 19% - in part due to positive FX effects and especially due to portfolio adjustments. The core earnings per share (which is only including continuing operations) grew 14.3% to €6.40. The company could also improve the EBITDA before special items margin from 24.4% in 2018 to 26.4% in 2019. Only free cash flow declined about 9% to €4.2 billion, but the number was much higher than the company’s previous guidance.

(Source: Bayer Investor Presentation)

As Bayer has sold the Animal Health segment to Elanco

If you enjoyed the article and like to learn more about wide moats, please check out my marketplace service: Moats & Long-Term Investing.

Subscribers get access to extensive background information on wide-moats, at least weekly exclusive research, a watchlist of wide moat companies and a chatroom where members can ask questions and exchange opinions about long-term investing and companies with a competitive advantage.

For investing in companies that can beat the market over the long term and create a portfolio with companies you can (almost) hold forever, please check out my marketplace service. You can also take advantage of a free trial offer.