Investment thesis

Source: benchmarkcorporate.com

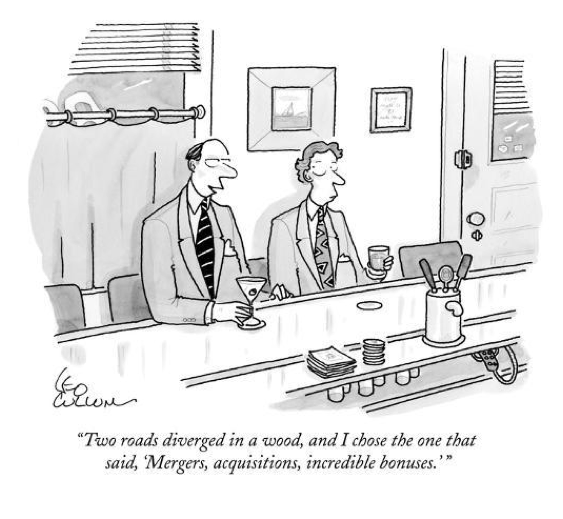

As interest rates hit rock bottom and risk of recession looms, valuations in the consumer staples sector are at all-time high. Although the inverse relationship between interest rates and valuations is not surprising, extremely low interest rates also act as an incentive for companies in slow-growth industries to look for consolidation.

Church & Dwight (NYSE:CHD) is one of the companies in the sector that has taken this strategy to the extreme. By not properly integrating its newly acquired businesses, paying hefty premiums and planning to continue spending heavily on acquisitions, CHD growth strategy relies heavily on new acquisitions.

Usually, a too aggressive growth strategy through M&A deals does not by itself support a short thesis, but in the case of CHD, there are a number of other red flags. CHD's spectacular free cash flow growth has been achieved on the back of low capital expenditures, aggressive working capital practices, and falling asset turnover and marketing spend relative to sales.

Finally, the company's M&A strategy seems purely short-term oriented while synergies and proper business integration are taking the back seat. Many of the highly priced recent acquisitions rely on higher penetration of whole product categories and do not offer any significant competitive advantages that would allow CHD to retain its long-term market share.

As a result of all that, CHD would most likely significantly under-perform the consumer staples sector. Since CHD's flawed strategy relies heavily on low interest rates, which are now headed towards zero, there is a short-term risk involved for short sellers as the company might see a temporary boost from the loose monetary policy. Therefore, for the time being, the best way to take advantage of CHD's mispricing would be a long/short strategy alongside the best-in-class consumer staple companies, such as Clorox (