Shares of BlackRock (NYSE:BLK) are looking like a compelling opportunity for long-term investors in these distressed markets. The shares have now dropped around 28% from their 52-week highs of $577 to trade at $414 and a 14.5x TTM P/E. That fall has pushed the dividend yield all the way up to 3.5%. Adding in average share buybacks of 2% since 2008, total shareholder returns are an even stronger 5.5% Buying the index at market lows is often a good investment for long-term investors, and buying the largest asset management company in a market slump, whose revenues are directly tied to market asset values, should be just as good a move, if not better.

An Intro to the Company

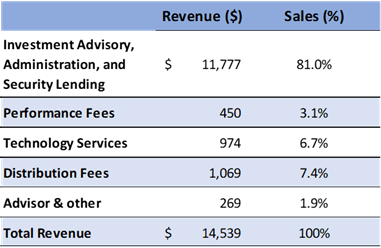

BlackRock is the largest asset manager in the world and collects revenue from administration fees, performance fees, investment advisory fees, security lending fees, distribution fees, and technology service revenues. Base fees earned on assets under management (AUM) make up the large majority of revenues at 81% for 2019, but this segment has a somewhat diversified client base within it. Breaking down AUM fees, BlackRock's popular iShares ETF products made up only 30% of AUM fees in 2019 with Retail and Institutional AUM making up the bulk of the rest.

|  |

Sourced from 2019 financial statements

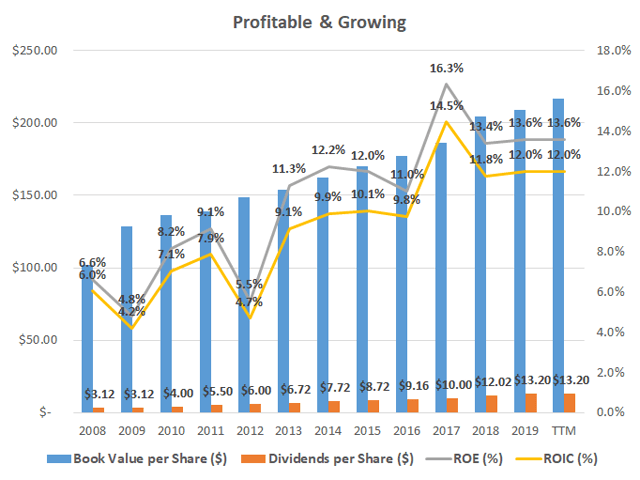

A Highly Profitable and Growing Company

BlackRock's position as the largest global asset manager with a diverse product offering has allowed the company to generate superior returns. While the company is cyclical along with the stock market due to it earning fees on AUM, operations have consistently remained profitable over the past 12 years, including the financial crisis.

Source data from Morningstar

Since 2008, the company has achieved an average return on equity [ROE] and return on invested capital [ROIC] of 10.3% and 8.9% respectively. This level