Introduction

We are in a time where all the investors' attention is focused on the equity market and its volatility amid the new coronavirus, the oil price war, and the subsequent fiscal and monetary stimulus. Against the background of the global uncertainties and the risk of a world recession, still, new preferred stocks continue to emerge, although to a lesser extent than in the previous months. For January, we have a total of 7 fixed-income securities issued, while for February, the number is 12. At this point, for March we have only 1 preferred stock issued, and that is exactly the newest Preferred Stock issued by First Citizens BancShares, Inc. (NASDAQ:FCNCA). In this article, we want to acquaint market participants with the newest fixed-income security that shows up on the exchange, to see how it holds up against its peer group, and to determine whether it will find its place in our portfolio or if there is a better alternative.

The New Issue

Before we submerge into our brief analysis, here is a link to the 424B5 Filing by First Citizens BancShares, Inc. - the prospectus.

Source: SEC.gov

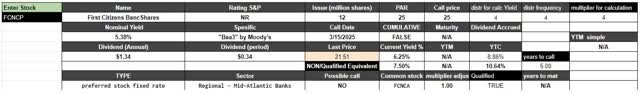

For a total of 12M shares issued, the total gross proceeds to the company are $300M. You can find some relevant information about the new preferred stock in the table below:

First Citizens BancShares, Inc. 5.375% Non-Cumulative Perpetual Preferred Stock, Series A (NASDAQ: FCNCP) pays a qualified fixed dividend at a rate of 5.375%. The new preferred stock bears no Standard & Poor's rating but is rated a "Baa3" by Moody's. FCNCP is callable as of 03/15/2025 and it is currently trading below its par value at a price of $21.51. This translates into a 6.25% Current Yield and a YTC of 8.86%.

Here's how the stock's YTC curve

Trade With Beta

Coverage of Initial Public Offerings is only one segment of our marketplace. For early access to such research and other more in-depth investment ideas, I invite you to join us at 'Trade With Beta.'