Despite retaining dividends on 50-cent levels, everything else looks sub-optimal for the company highlighted by the Net Income decrease of 25% to $1.23B combined with the supply chain problems brought by the Pandemic. Digitalization is affecting the business but International Paper (NYSE:IP) is leaning on sustainability as its main driving force.

Supply Chain Woes

With the current suspension of Europe travels to the US and the lockdown of different countries due to the virus, the supply chain for global manufacturers such as International Paper will be greatly affected.

Industrial Packaging comprises 69% of the Paper Manufacturer's total Revenue.

Italy, one of Europe's largest producers of corrugated cardboard (second only to Germany), is one of the major countries that have already declared a lockdown. It is expected that these types of disruptions will affect the supply of Raw Materials and it will be a ripple effect from there. The costs associated with backorders, and alternative logistics & procurement procedures to mitigate stockouts and customer attrition will shoot up the company's operational expenses.

The Cash Flow/Share is still sufficiently sitting at 5.72 (TTM) but has been on a steady decline since Q2 of 2019.

Analysts: Don't pass your Papers yet

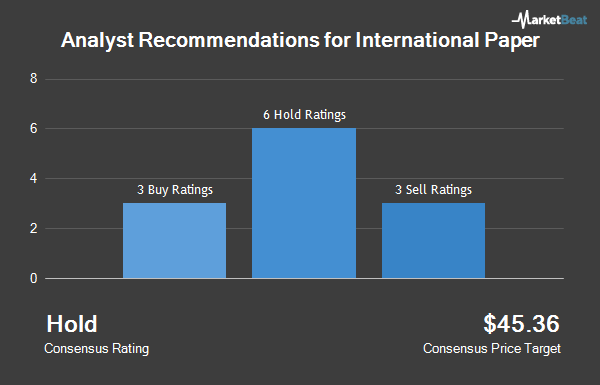

The general sentiment by Analysts results in an average "Hold" rating. With the stock currently hovering around the $28-30 range, the $45.36 price target suggests a possible upside of up to 62%.

Source: Marketbeat Price Target and Consensus Rating

On the flip side, said estimates are still to be taken with a grain of salt until sentiments have shown signs of recovery.

Digitalization means trouble

The rapid growth of Digitalization, AI and Machine Learning in all industries is already being felt by the Printing Industry. Over time, the transition from traditional packaging and print products to digital media is imminent.

Obviously, this means