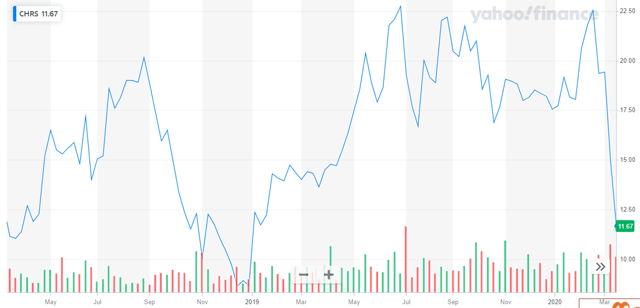

Today, we will see why Coherus BioSciences (NASDAQ:CHRS) is an attractive pick in 2020.

Company overview

Coherus BioSciences is a commercial-stage biotherapeutics company focused on developing biosimilars. The company has a mix of wholly-owned internally developed biosimilar assets as well as wholly-owned internally developed assets. The company's commercial asset, Udenyca, is a long-acting granulocyte-colony stimulating factor and stimulates the production of granulocytes in order to promote the body's ability to fight infections. Udenyca is a biosimilar version of Amgen's (AMGN) Neulasta.

Coherus BioSciences is also working on clinical-stage assets in areas of oncology, ophthalmology, and immunology. In ophthalmology, the company aims to launch biosimilars for Lucentis and Eylea in the U.S. in the coming years. Coherus has also acquired commercial rights for Avastin's biosimilar in the U.S. and Canada from China-based Innovent Biologics (OTCPK:IVBIY). Finally, the company plans to launch Humira biosimilar in 2023.

Udenyca has managed to achieve the company's guidance of over 20% market share by the end of 2019

In November 2018, Coherus BioSciences announced FDA and EC (European Commission) approval for Udenyca, the first pegfilgrastim biosimilar for patients with cancer receiving myelosuppressive chemotherapy. One year after the drug's launch, Udenyca managed to end 2019 with a 20.5% share of the pegfilgrastim market in the U.S. The market share gains were achieved across all segments which included 340B hospitals and non-340B hospitals as well as both prefilled syringe and on-body injector formats. In certain weeks, Udenyca's market share rose as high as 23.5%. This is exceptional considering that Udenyca is competing not only with Amgen's Neulasta but also with Mylan's (MYL) biosimilar Fulphila which entered the market almost six months ahead of Udenyca.

Coherus BioSciences became cash flow positive in the second quarter of 2019, two quarters ahead of its guidance. The company's successful Udenyca launch without taking significant