Investment Thesis

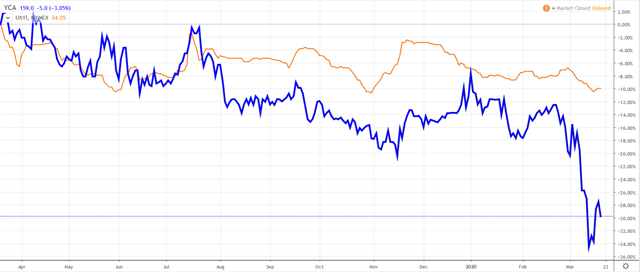

Yellow Cake (OTCPK:YLLXF) is an investment company that owns uranium and has little to no operational exposure to COVID-19, but has sold off significantly despite the fact that the price of uranium has remained relatively stable recently. The latest stock price is £1.59, the net asset value per share is at £2.32 given the latest $24.05/lb price of uranium.

Given the discount to net asset value in Yellow Cake, we are looking at significant upside from just a modest recovery in the price of uranium and if the stock returns to trade at NAV per share.

Figure 1 - Source: TradingView

Figure 1 - Source: TradingView

Operating Risks & Costs

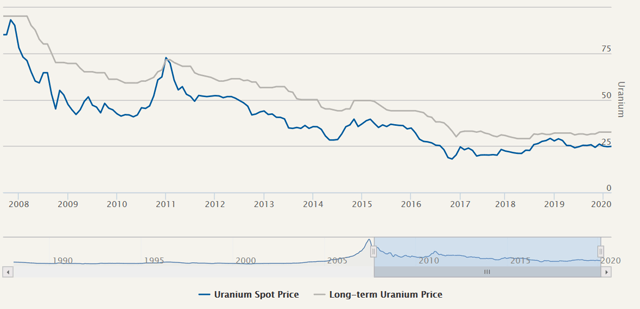

There are very few publicly listed uranium mining companies which are still producing due to the depressed uranium price. While some of those stocks likely has a higher leverage to the price of uranium, when the market finally recovers. The return potential for Yellow Cake is now also very substantial. Few companies in the industry offers a more attractive risk-reward, given the discount to NAV and limited operational risk.

Figure 2 - Source: Cameco

Figure 2 - Source: Cameco

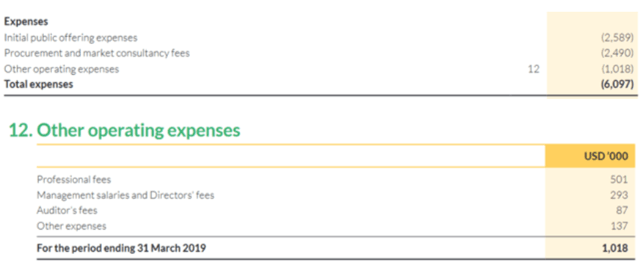

Total expenses during the last fiscal year were $6.1M, but that also entailed IPO expenses and procurement costs. My expectation is that the company has costs somewhere around $2M for the year, which is about 0.8% of net asset value as of the last operating update in December of 2019.

Figure 3 - Source: Yellow Cake Annual Report

Figure 3 - Source: Yellow Cake Annual Report

Share Buy-Backs

During 2019, the company communicated that should the discount to net asset value increase, buy-backs will be performed. Over the last month, the company has been buying back shares almost on a daily basis.

When you have an unleveraged investment company with plenty of cash to support operations, that trade with a significant discount to NAV, I think there are few