Introduction

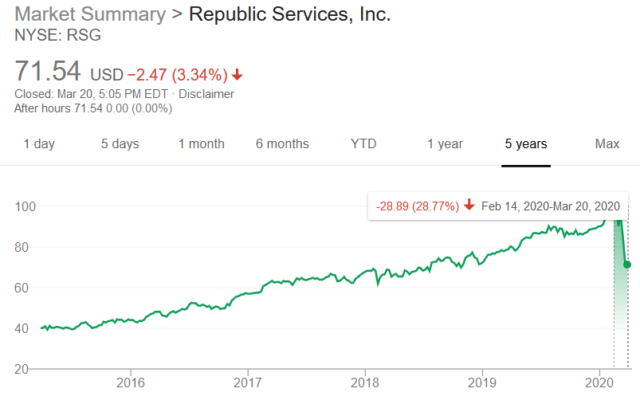

COVID-19 outbreak has brought an end to the 11 year long bull market and the majority of the population is hunkered down. Sell-off in the broader market has also affected players that are immune to the problem. Republic Services (NYSE:RSG) fell ~30% from it's all-time-high levels in Feb. Waste collection is an essential service and will continue to function normally during this difficult time. In my opinion, this drop presents a great buying opportunity for investors with a long term vision.

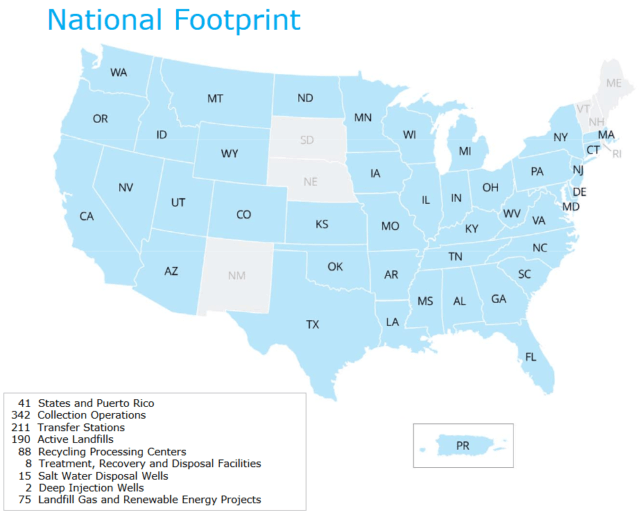

Republic Services is the second largest provider of non-hazardous solid waste collection, transfer, disposal, recycling, and environmental services in the United States after Waste Management (WM). As of December 31, 2019, the company operated facilities in 41 states and Puerto Rico.

Republic Services is the second largest provider of non-hazardous solid waste collection, transfer, disposal, recycling, and environmental services in the United States after Waste Management (WM). As of December 31, 2019, the company operated facilities in 41 states and Puerto Rico.

Source: Investor Presentation

Valuation

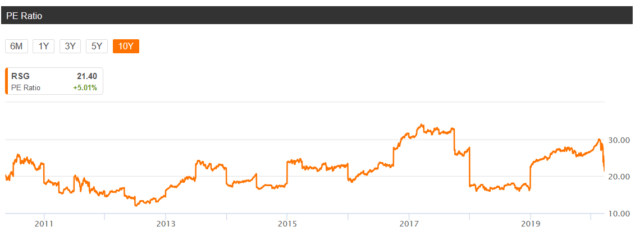

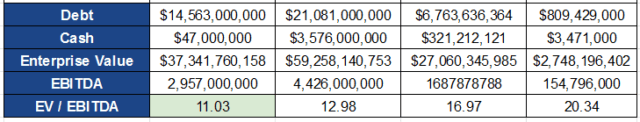

Peter Lynch tells us to look for companies that do boring, disagreeable, sad and repulsive work. Thanks to the popularity of his books, this knowledge is quite common among value investors. Hence, companies managing solid waste often trade at high multiples.

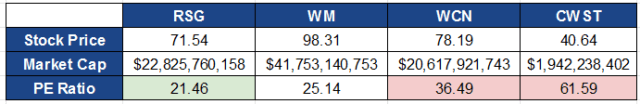

Source: Author's calculations

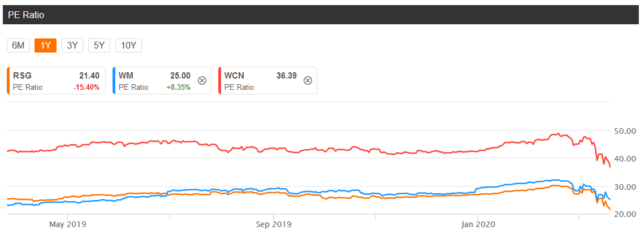

RSG currently trades at a lower price multiple compared with Waste Management, Waste Connections (WCN) and Casella Waste (CWST).

Source: Seeking Alpha

Source: Seeking Alpha

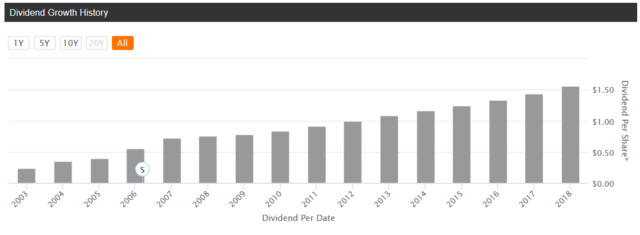

Republic Services has a history of raising dividends and its current quarterly dividend of $0.405 amounts to a 2.26% annual yield.

Source: Seeking Alpha

Source: Author's calculations (WCN amounts were converted to USD using Bank of Canada exchange rate for 2019)

Compared to its peers, Republic Services offers the best value proposition and the stock price drop provides a comfortable entry point.

The Business

80% of Republic Services revenue is annuity type and 75% of the total revenue is from its collection business (source: Investor Presentation). Collection Revenue experienced a 2.8% YoY growth in 2019.

COVID-19 impact

Scientists discovered the coronavirus is