For many US investors in high income tax brackets, tax-exempt municipal bonds often serve as an important source of income in otherwise taxable accounts. In most normal times, the exemption of municipal bond interest from income tax makes many of these bonds trade at lower yields than similar maturity US treasuries until the after-tax yield / taxable equivalent yields are only slightly higher than treasury yields. In the market crash we have seen so far in 2020, municipal bond funds have seen significant declines in their values, so that even high grade munis have been trading at taxable equivalent yields 4x US treasury levels. In this article, I will compare and contrast three very different tax-exempt municipal bond funds, and explain why I am buying what seems to be the "highest risk" one on this dip. These three funds are:

The iShares National Muni Bond ETF (MUB), yielding around 2.5%

- The VanEck Vectors High-Yield Municipal Index ETF (HYD), yielding around 5.5%, and

- The Invesco Trust for Investment Grade Municipals (VGM), also yielding around 5.5%

For an investor in the 37% federal income tax bracket (most of whom would have a taxable income over $500,000/year), these would correspond to "taxable equivalent yields" (TEYs) of almost 4%, 8.7%, and 8.7% respectively. Investors in the 22% federal income tax bracket (for example, married filing jointly making around $80-160k/year) would find these TEYs to be the still attractive levels of 3.2%, 7% and 7% respectively. By contrast, the iShares 7-10 Year Treasury Bond ETF (IEF), which holds US treasuries with a weighted average duration of 7.6 years, currently yields less than 1%. Yields reached these relatively extreme levels because of how MUB, HYD, and VGM prices declined by around 10%, 17%, and 27% over just the past month, while IEF prices rose slightly.

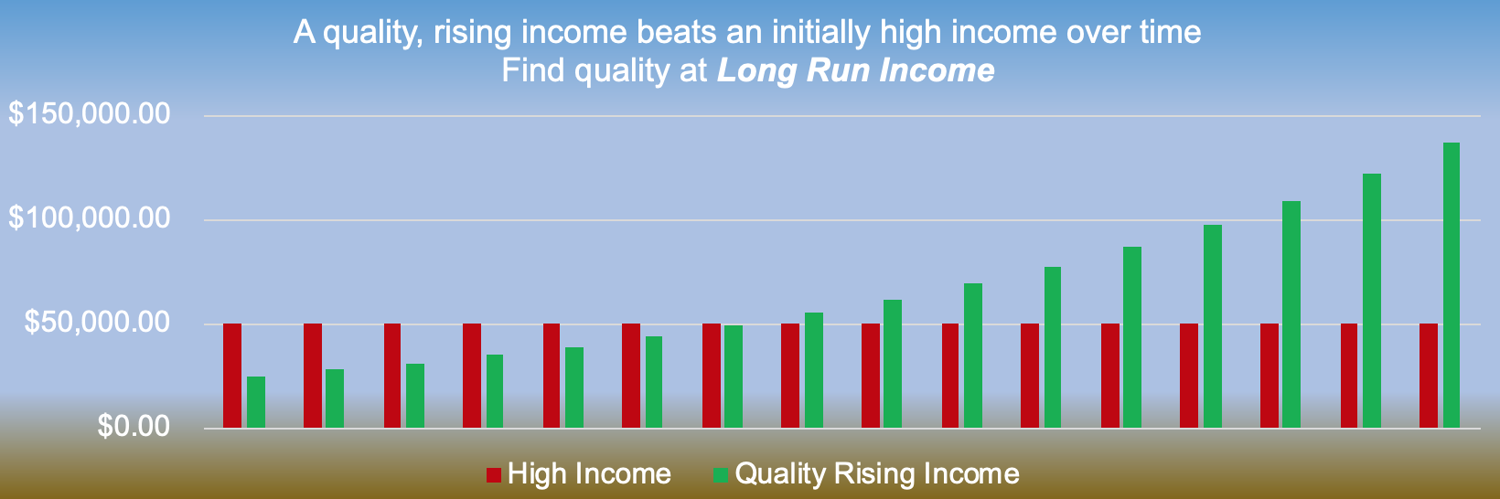

Members of Long Run Income get more regular short form analysis, screens, model portfolio updates, and ideas like these that can significantly increase your retirement income over time. Although my focus tends to be on high quality, dividend paying companies, I also look at "dividend alternatives", bonds, MLPs, closed end funds, and many other investments income investors ask about. See more of my latest ideas with your free trial to Long Run Income.