The 2020 market selloff is creating both huge short-term risks and massive long-term opportunities for investors. It is important to manage your overall portfolio risk in a smart way during this period, but you also want to capitalize on the opportunity to buy high-quality growth stocks at attractive valuation levels. With this in mind, I have been buying Twilio (NYSE:TWLO) stock during the market crash in recent weeks.

It is hard to know what will happen to the stock price in the next 1 to 3 months, but over the next 1 to 3 years there is a good chance that Twilio stock will deliver remarkably attractive returns from current levels.

The Business And The Stock Price

Twilio made historical highs at $150 per share in June of last year, and the stock has retraced by over 35% from those levels. However, the company keeps firing on all cylinders and growing at full speed as of the most recent earnings report.

Like all other companies in the world, Twilio will be facing increased uncertainty in the near term, and the economic slowdown could have a material impact on the business. But the company is in a position of strength to benefit from growing demand for all kinds of online communications in the years ahead.

Twilio is a communication platform-as-a-service that developers can utilize to facilitate communication via text, voice, video, and email in 180 countries. When you send a voice message via WhatsApp, or when you get a notification from Uber, those services are powered by Twilio.

These kinds of communications are increasingly crucial for corporations in times of social distancing, and the current crisis will highlight the utmost importance of building strong relationships with customers and providing the best possible engagement experience via world-class communications tools.

According to data

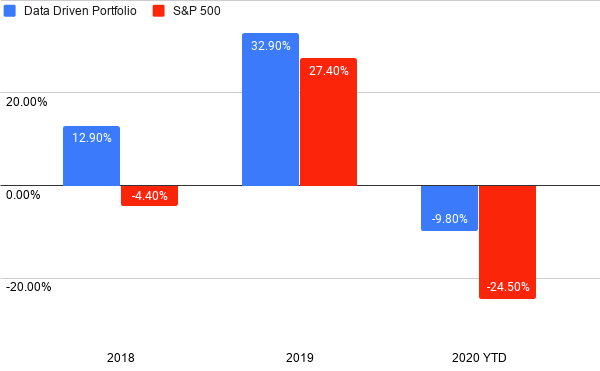

A subscription to The Data Driven Investor provides you with solid strategies to analyze the market environment, control portfolio risk, and select the best stocks and ETFs based on hard data. Our portfolios have outperformed the market by a considerable margin over time, and The Data Driven Investor has an average rating of 4.9 stars out of 5. Click here to get your free trial now, you have nothing to lose and a lot to win!

Performance as of March 24, 2020