Overview

Corteva (NYSE:CTVA) has sold off with the rest of the market over the past month due to the Covid-19 outbreak. Corteva, a global leader in the development of seed and crop chemical products (each generate ~50% of revenue), is used to the cyclical nature of the industry. However, we believe that the current pandemic will have little, if any, impact on demand within the ag sector.

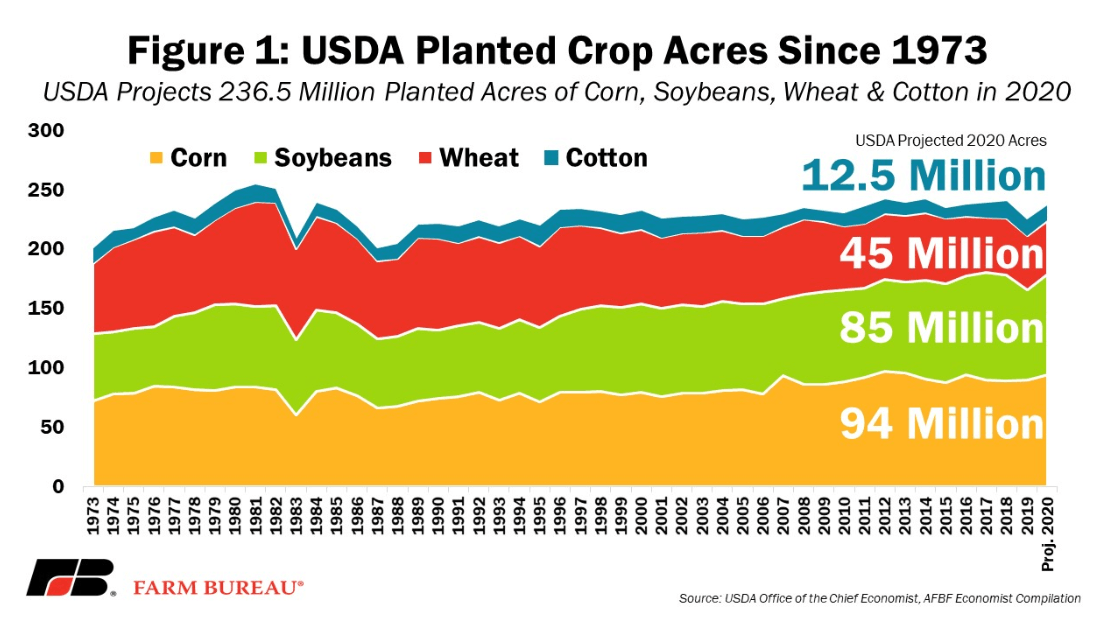

Additionally, there are a number of reasons to like the business other than the fact that the stock has sold off considerably. The industry should benefit from stronger plantings in 2020, as adverse planting and growing conditions negatively impacted crop production in 2019. As we continue through the year, all signs point toward a bounce back in production with few disruptions. Further, Corteva doesn't have exposure to the volatility of fertilizer prices. While we still like ag stocks with fertilizer exposure, we believe that Corteva is a safer play. Finally, the company should be relatively insulated from a disruption in its supply chain. Seeds are manufactured locally, and although its chemicals are manufactured throughout the world, Corteva doesn't have significant exposure to one country.

Corteva's Seed Portfolio Should See A Strong Rebound In 2020

Corteva's seed portfolio is largely centered around corn which accounted for ~67% of 2019 seed revenue. Soybeans accounted for ~18%. This shouldn't come as a surprise since these two crops account for more acres planted than any other crop produced in the United States. 2019 was one of the worst years for farmers in recent history, and we expect more favorable conditions in 2020. Although we're only a quarter into the year, the harvest season is already underway with little disruption.

The USDA estimates that corn planted acres will increase to 94 million in 2020, a 4.8% increase from 2019 89.7