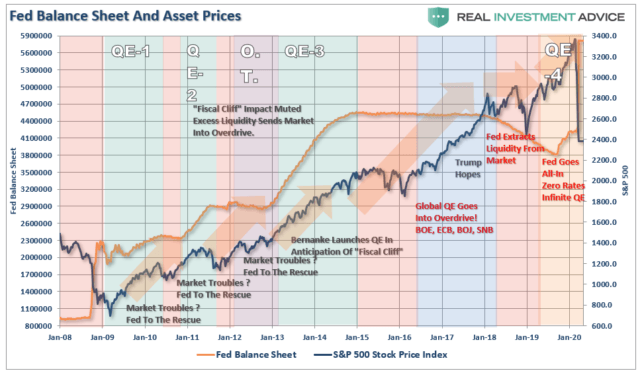

Over the last couple of years, we have often discussed the impact of the Federal Reserve's ongoing liquidity injections, which was causing distortions in financial markets, mal-investment, and the expansion of the "wealth gap."

Our concerns were readily dismissed as bearish as asset prices were rising. The excuse:

"Don't fight the Fed"

However, after years of zero interest rates, never-ending support of accommodative monetary policy, and a lack of regulatory oversight, the consequences of excess have come home to roost.

This is not an "I Told You So," but rather the realization of the inevitable outcome to which investors turned a blind eye in the quest for "easy money" in the stock market.

It's a reminder of the consequences of "greed."

The Liquidity Trap

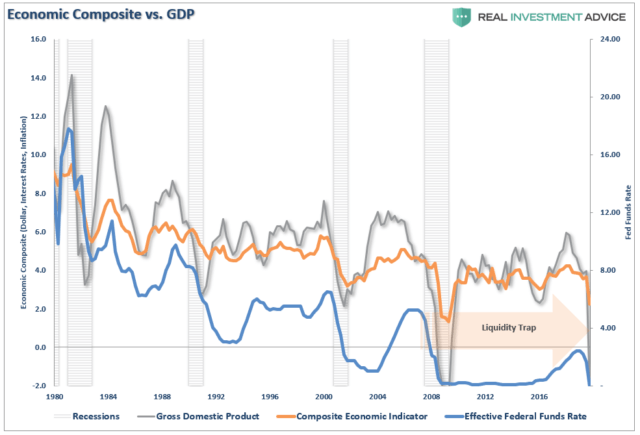

We previously discussed the "liquidity trap" the Fed has gotten themselves into, along with Japan, which will plague economic growth in the future. To wit:

"The signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels."

Our "economic composite" indicator is comprised of 10-year rates, inflation (CPI), wages, and the dollar index. Importantly, downturns in the composite index lead GDP. (I have estimated the impact to GDP for the first quarter at -2% growth, but my numbers may be optimistic)

The Fed's problem is not only are they caught in an "economic liquidity trap," where monetary policy has become ineffective in stimulating economic growth, but are also captive to a "market liquidity trap."

Whenever the Fed, or other Global Central Banks, have engaged in "accommodative monetary policy," such as QE and rate cuts, asset prices have risen. However, general economic activity has not, which has led to a widening of the "wealth gap" between the