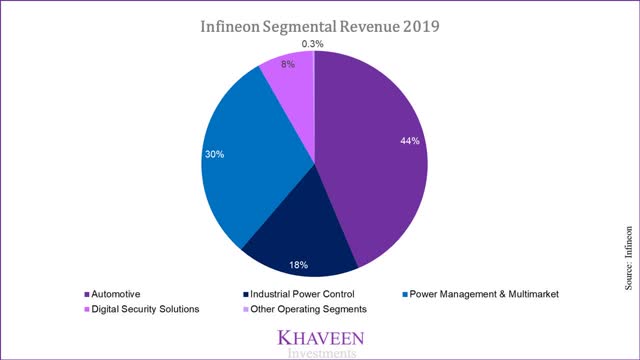

Infineon Technologies (OTCQX:IFNNF), a semiconductor powerhouse in its own right, has long been a presiding player in the key markets it operates in. The company holds the number 1 market share position in power & discrete modules and security integrated circuits. Its major competitor NXP Semiconductors (NXPI), has always narrowly edged out Infineon in automotive electronics, until now. Not only does the Cypress acquisition give them the leading position in this segment, the combined revenue of Infineon (€7.6 bln) and Cypress ($2.2 bln), will now also spearhead them in front of NXP (€9.4 bln). This is a huge win for Infineon as the automotive segment is its largest revenue driver representing 44% of total revenue.

Infineon's other key business segments are Industrial Power Control, Power Management & Multimarket, and Digital Security Solutions, as seen below.

Source: Infineon

- Automotive: Chips used in powertrains (engine, transmission), comfort electronics (steering, absorbers, air conditioning) and safety systems (ABS, airbags). 2019 segment revenue of €3.533 mln, a 7.6% increase from the previous year.

- Industrial Power Control ('IPC'): Power semiconductors and modules used for generation, transmission and consumption of electrical energy for industrial applications and household appliances, energy production, conversion and transmission. Segment achieved sales of €1,445 mln in fiscal year 2019, a 9.2% Y/Y increase.

- Power Management & Multimarket ('PMM'): Semiconductor components for efficient power management used in LED lighting, servers, PCs, notebooks and consumer electronics. In 2019, PMM increased 3.9% Y/Y to €2,409 mln.

- Digital Security Solutions ('DSS'): Provides microcontrollers for mobile phone SIM cards, payment cards, security chips for passports, identity cards and other official documents. DSS achieved €642 mln in fiscal year 2019, and was the only segment to drop in revenue.

Cypress Acquisition

When we spoke to Infineon Investor Relations last week, it was confirmed the acquisition is