ETF Overview

Fidelity MSCI Utilities Index ETF (NYSEARCA:FUTY) owns a portfolio of U.S. utility stocks. The fund seeks to track the investment results of the MSCI USA IMI Utilities Index. Stocks in FUTY's portfolio are considered defensive stocks as they tend to generate stable and predictable cash flows. In fact, stocks in FUTY's portfolio have consistently increased their dividends in the past. Given the uncertain macro environment caused by the outbreak of COVID-19, we think FUTY is a good investment choice as its stocks are mostly recession resilient stocks.

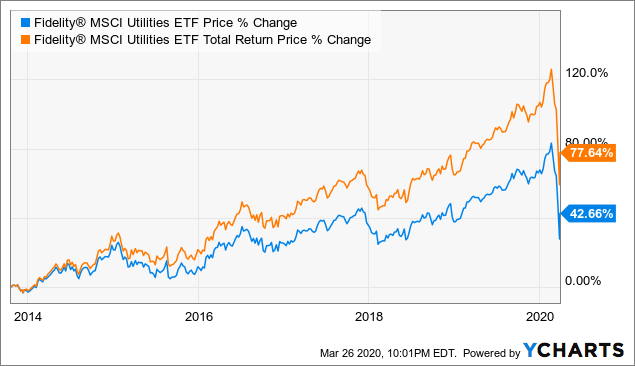

Data by YCharts

Fund Analysis

Utility stocks are moaty stocks by nature

FUTY's portfolio consists of 65 stocks and its top-10 holdings represent about 55% of the total portfolio. A large portion of these stocks' revenue is derived from its regulated utilities. In other words, these stocks are stocks with limited competitions. Since majority of these companies' revenues are derived from businesses that provide essential services (e.g. electricity transmission and generation, natural gas delivery, etc.), they generate stable and predictable cash flows. Therefore, it is not surprising that most of these stocks receive moaty status according to Morningstar's research.

Morningstar Moat Status | Financial Health Rating | % of ETF | |

NextEra Energy (NEE) | Narrow | Moderate | 12.70% |

Dominion Energy (D) | Wide | Moderate | 6.85% |

Duke Energy (DUK) | Narrow | Moderate | 6.77% |

Southern Co. (SO) | Narrow | Moderate | 6.50% |

American Electric Power (AEP) | Narrow | Moderate | 4.47% |

Exelon Corp. (EXC) | Narrow | Moderate | 4.15% |

Sempra Energy (SRE) | Narrow | Moderate | 3.97% |

Xcel Energy (XEL) | Narrow | Moderate | 3.60% |

WEC Energy Group (WEC) | Narrow | Moderate | 3.15% |

Consolidated Edison (ED) | None | Moderate | 2.91% |

Total: | 55.07% |

Source: Created by author

Slow growth expected in the next few decades

Utility sectors include many subsectors such as electric utilities, gas utilities, independent power producers, multi-utilities, etc. As can be seen from the chart below, about 58% of FUTY's portfolio consists