Overview of Dunkin' Brands

The Dunkin' Brands Group (DNKN) is a franchisor of two quick-service restaurants; Dunkin' (formerly Dunkin' Donuts) and Baskin-Robbins. Their business model is asset-light with a 100% franchised model. The financials have been reliable and provide strong free cash flow conversion.

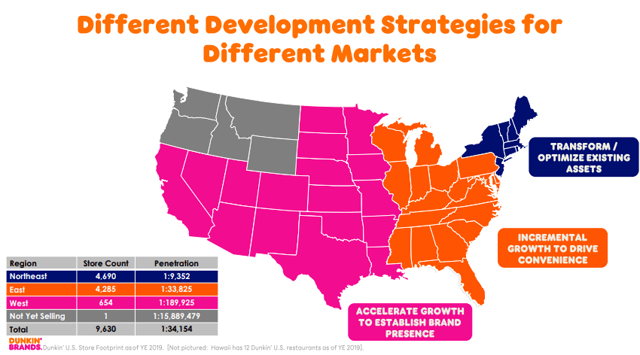

I have been a long-term investor in Dunkin' because of their ability to grow their dividend. They are successfully doing so by consistently achieving positive same-store sales coupled with growth opportunities west of the Mississippi.

However, the COVID-19 pandemic has created challenging times, especially for a company that requires a capital intensive growth strategy. I analyze why Dunkin' is still a good bet and is poised for success in the post-pandemic economy.

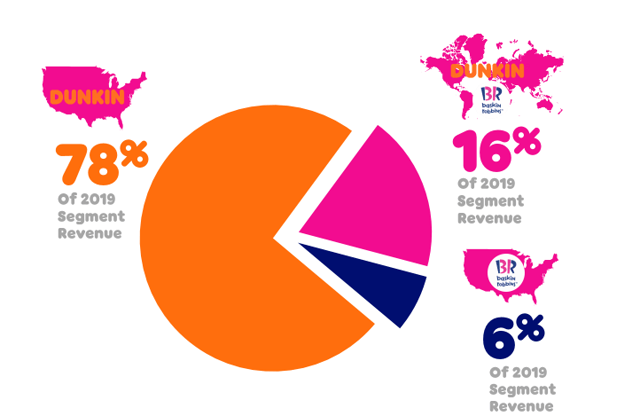

The analysis focuses on the Dunkin' U.S. because this segment makes up 78% of the company's revenue.

(Source: Dunkin' Brands Investor Relations)

Revenue Growth

Dunkin's cumulative average growth rate over the past five years is a very impressive 4.5%. What is driving the revenue growth is the positive same-store-sales from Dunkin' U.S. and new store openings from Dunkin U.S. and International. Last year, Dunkin' had a net of 385 additional locations; 211 U.S. and 174 international. Existing U.S. locations had a positive comp of 2.1%. The positive comp was driven in part by the successful re-branding of the name, dropping the donuts to become just Dunkin', that became official on January 1, 2019.

(Source: 10-K SEC.gov)

Dunkin' U.S. and International were the best performing businesses at Dunkin' with the growth of 5.0% and 7.6%, respectively. With their existing base performing so strongly, it takes the pressure off the new location expansion. But there has been a lot of pull demand from existing and new franchisees to continue the expansion.

(Source: Dunkin' Brands Investor Relations)

Dunkin' is based in the northeast, and that is where the core