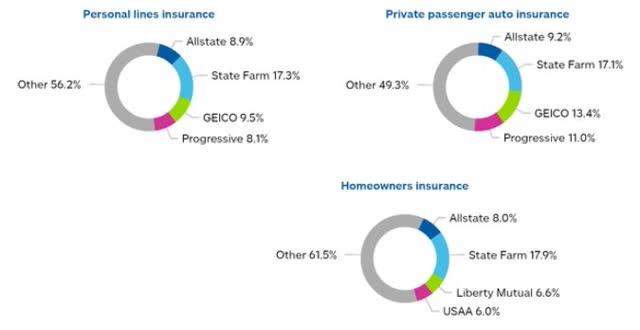

The Allstate Corporation (NYSE:ALL) is one of the largest property and casualty insurance operations in the United States and Canada. The Allstate Protection segment accounted for 90% of 2019 consolidated insurance premiums and contract charges. The company is a top four North American underwriter of auto, homeowners, plus personal and commercial insurance products offered through agencies and online selling. Life insurance and financial investment products represent another 4% of revenues. Identity protection and specialized roadside service contracts account for another 3%, while accidental death and short-term disability products fill out the other 3%. The company employed about 30,000 agents writing 113 million policies last year.

Image Source: Allstate 2019 10-K

Image Source: Allstate 2019 10-K

Allstate is a "steady as she goes" blue-chip enterprise for investors to consider. The company's well-diversified revenue stream and asset/liability backdrop make it a great idea to consider, especially during a recession and uncertain economic future. Is it a high growth darling? No. Is it completely insulated from the coronavirus slowdown? No. Will it provide long-term investors with average to better-than-average total returns vs. the S&P 500 at its current quote? Probably.

Image Source: Company Website

Image Source: Company Website

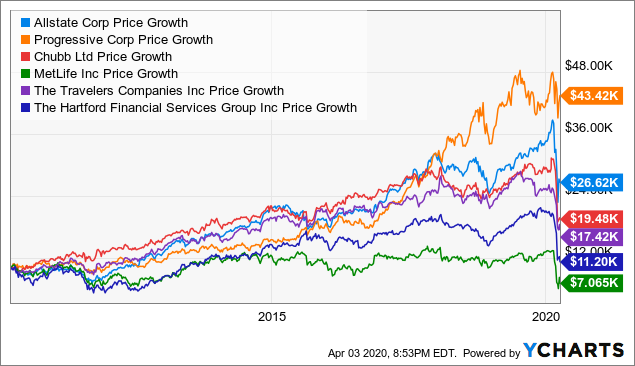

You can see below how Allstate's price performance has outgained the vast majority of U.S. stocks on a 1-year and 10-year basis compared to peer S&P 500 blue-chips or smaller-cap rivals for your investment capital in the Russell 2000 index.

In addition, compared to larger diversified insurance peers, Allstate has been a leader for performance, only rivaled by less diversified Progressive (PGR). Chubb (CB), MetLife (MET), Travelers (TRV), and Hartford (HIG) investors have not kept up with Allstate's profitable pace of gains the past decade.

Balance sheet ready for turmoil?

One important reason Allstate has done well over the years is its conservative balance sheet, including diversified asset ownership. Nearly $120 billion in assets, funded from premiums received