Xerox's (XRX) latest move to officially withdraw its bid to acquire HP (NYSE:HPQ) strikes me as a net positive for HPQ shareholders, with the road now clear for HPQ to resume its planned share repurchase program over the coming 12 months. The value proposition for XRX appears to be less sanguine as a coronavirus-driven recession scenario leaves the company highly vulnerable, given its outsized enterprise printing exposure. HPQ's exposure to the consumer and PC/notebooks should offset any enterprise weakness as the work-from-home shift looks set to boost demand in the near-term.

Following the sell-off, HPQ stock screens attractively at ~4-5x post-recession earnings and a sizable buyback program to boot. That said, there's too much uncertainty at this juncture, and pending further clarity into its earnings power prospects and capital return plans, I would sit this one out.

What Happened?

Last week, the WSJ reported what most had already expected - Xerox ended its hostile ~$30b tender offer and proxy fight for HPQ. Reasons cited by the WSJ include the present "public health crisis and resulting market swoon," with a subsequent XRX press release echoing the message, but also noting the "tremendous support for the transaction" from HPQ shareholders and the "significant backing" from both XRX and HPQ shareholders. Excerpt from the full statement below:

The current global health crisis and resulting macroeconomic and market turmoil caused by COVID-19 have created an environment that is not conducive to Xerox continuing to pursue an acquisition of HP Inc.

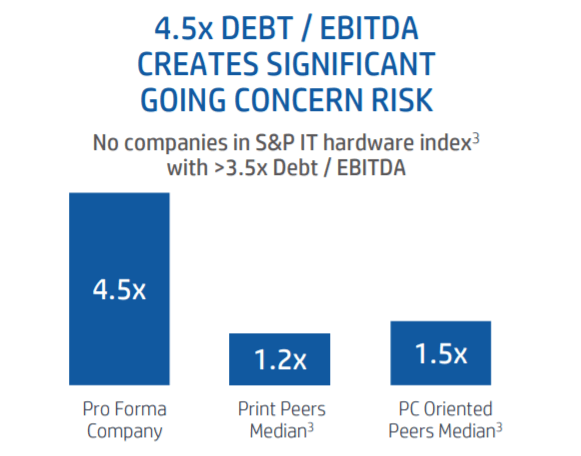

That said, I do not think the HPQ-XRX saga is over – a Printing industry consolidation still makes sense, especially when taking a long-term view. Though valuations are down significantly, I do think the decision makes sense, given the amount of leverage implied by a pro-forma XRX + HPQ entity post-transaction.

Source: HP Investor