Food, water, and shelter. You've heard of the necessities of life and you know that they're the safest place to have your money during a recession. The only problem is that there isn't much of a discount to be had among most grocery store, food manufacturer, and utility stocks.

However, Wall Street seems to have forgotten the third necessity altogether. I believe the roofing industry should be considered essential, alongside other recession proof industries. The idea is that a leaky roof will always take priority over the latest smartphone or a new car. A roof in need of replacing now will be the first thing homeowners purchase after the Coronavirus lockdown blows over. With that said, over the last month the industry has taken a beating far worse than the overall market.

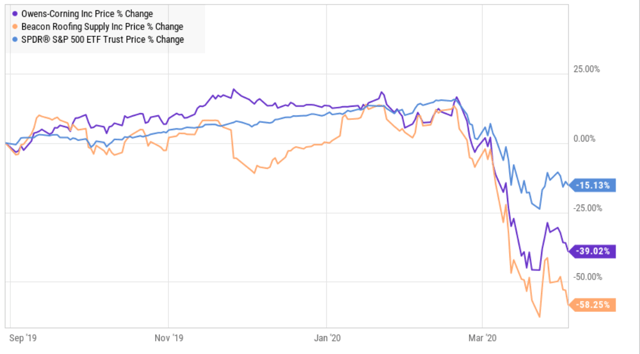

Owens Corning (OC) and Beacon Roofing Supply (BECN) have dropped by 39% and 58% respectively, and are now trading at levels not seen since 2012.

In 2008 the same thing happened to a lesser degree:

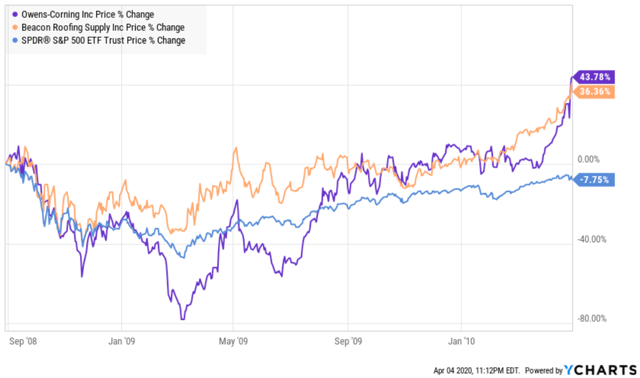

We can see that the discount of Owens Corning and Beacon Roofing Supply were incredibly short-lived. The following year, the two stocks outperformed the SPY by an average of almost 200%. This is because the roofing industry's revenue was not affected by the 2008 crash:

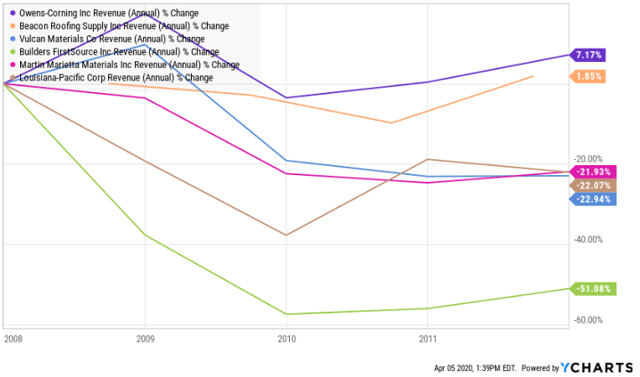

Throughout the Great Recession, Owens Corning and Beacon Roofing Supply's revenue actually grew in a time where all building supply sales were down over 20%. The same phenomenon can be seen in other bear markets, showing a ubiquitous misunderstanding of the industries strength. The cyclical nature of the construction industry doesn't apply to the roofing industry.

Be that as it may, I consider myself a realist when it comes to the impact of a global economic shutdown. Pain will be felt by all in the short term