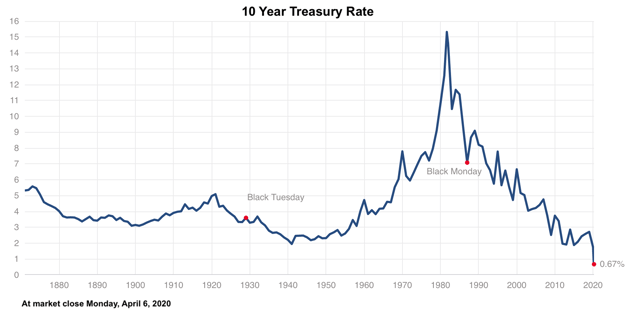

With the decline of the stock market this year as a result of the coronavirus pandemic, investors have been buying 10 year Treasuries in their quest to decrease risk and preserve the value of their investments. On February 19th, when the S&P 500 peaked, the 10 year Treasury note yielded 1.57%.

Today, with the stock market down 21% from its peak, the 10 year Treasury is yielding 0.67%. The decline in yield has also been affected by the Federal Reserve's bond buying program. Since the market peaked in mid-February, investors have seen the yield cut by more than half.

Source: 10 Year Treasury Rate

No Longer a Safe Haven

For decades, the 10 year Treasury note has been seen as a safe haven for investors in times of economic uncertainty and extreme market volatility. The underlying assumption is that government bonds are backed by the full faith and credit of the United States government. This reputation has been earned since the U.S. government has never defaulted or missed an interest payment.

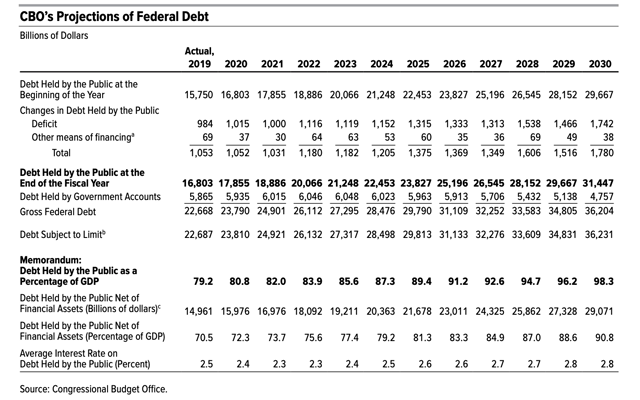

However, with the national debt at $17.4 trillion (as of the end of February) and rising, the U.S. government's ability to repay these notes 10 years from now becomes more uncertain. According to the Congressional Budget Office's (CBO) March 2020 report on the federal debt, it states, "if current laws generally remained unchanged, that debt would increase to $31.4 trillion, or 98 percent of GDP, by 2030. Such high and rising debt could significantly affect the U.S. economy and the federal budget." This estimate does not include an additional $2 trillion from the Cares Act that was passed in late March.

The relevance of this estimate by the CBO is that for investors who have been purchasing 10 year treasuries, those notes would mature in 2030 at the time the