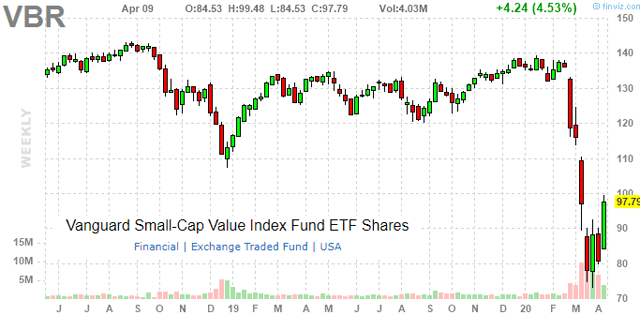

The Vanguard Small-Cap Value ETF (NYSEARCA:VBR) with $22.3 billion in total assets and an expense ratio of 0.07% is a low-cost fund that provides passive exposure to this market segment. It's been a difficult year for small-cap value, with VBR significantly underperforming the broader market and alternative equity style factors amid the coronavirus pandemic selloff. The fund is down 28.3% year to date compared to the S&P 500 Index (SPY), which is down a more modest 13%, including the sharp rally off the lows in March. Despite the deep pullback and more reasonable valuation levels, we maintain a cautious view on the fund as the market continues to reward large-cap growth and higher quality companies in this market environment.

(Source: finviz.com)

VBR Background

VBR seeks to track the underlying "CRSP U.S. Small Cap Value Index" which is responsible for categorizing the relevant stocks for inclusion. According to the index provider, the "value" style factor is determined using a multifactor model taking into account a combination of fundamental metrics.

Once securities are assigned to a size-based market cap index, they are made eligible for assignment to a growth or value index using CRSP’s multifactor model. Securities are scored and ranked for both Value and Growth factors, then ranked. CRSP employs a version of banding and migration between Value and Growth similar that can occasionally result in splitting securities between the two style assignments. CRSP classifies value securities using the following factors: book to price, forward earnings to price, historic earnings to price, dividend-to-price ratio and sales-to-price ratio.

The allure of value for investors is the potential that corresponding stocks are a lower risk with more upside to their intrinsic value. Value stocks are by definition priced with a cheaper valuation relative to growth stocks. Compared to the alternative Vanguard Small Cap

Are you interested to learn how this idea can fit within a diversified portfolio?

With the Core-Satellite Dossier, we sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks / ADRs to find the best trade ideas.

Get access to all our exclusive features including:

- Model portfolios built around different strategies.

- A tracked watchlist of our top picks.

- A weekly "dossier" with an updated market outlook.

- Access to analysts with a live chat

- Exclusive research covering all asset classes and market segments.

Click here for a two-week free trial and explore our content.