Co-produced with Trapping Value

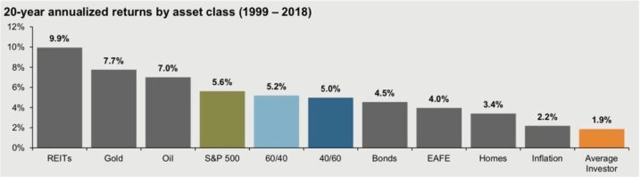

Equity values are based on cash flows over a long period of time. In other words, stocks have a very long duration (as implied by bond duration values). When you buy a company you are trying to own a multi-decade right to its cash flow. While events like the Coronavirus Pandemic can derail short-term cash flows, they don't change the long-term prospects significantly for a large swath of companies. Investors often forget that and focus on selling assets when times are tough and buying them when things look chirpy. That unfortunately results in a graph that looks like this.

Source: JPMorgan

Panicking when things get bad almost never pays off. At the same time though, we have to examine if the company can weather the short-term challenges. If that's definitely the case, it will survive and not be forced to issue stock or onerous debt at rock bottom prices, and we can make a case to buy in any crisis.

The Case For Real Estate

The narrative always is based on the present times. When things are good, real estate is touted as one of the best investments and phrases like "They are not making any more land," "Real Estate is the best hedge against inflation" regularly make the rounds. Today we are hearing different tunes altogether. One month of listening to negative headlines has convinced the masses that all of us will always work from home and visit a hotel once about every 30 years. A lot of this has to do with how the media reports items. For example saying "This is a temporary blip in the normal course of things" is not a headline that gets clicks. Instead we get this.

But the reality is often far less gruesome. Yes, things do change in